VAT Reports

In Zoho Books, the following VAT reports are auto-generated based on your sales and purchase transactions.

These reports help you file your VAT returns on monthly or quarterly basis. You would have chosen monthly or quarterly when you registerd for VAT. In Zoho Books, you would have selected it while setting up your organization.

Tax Returns

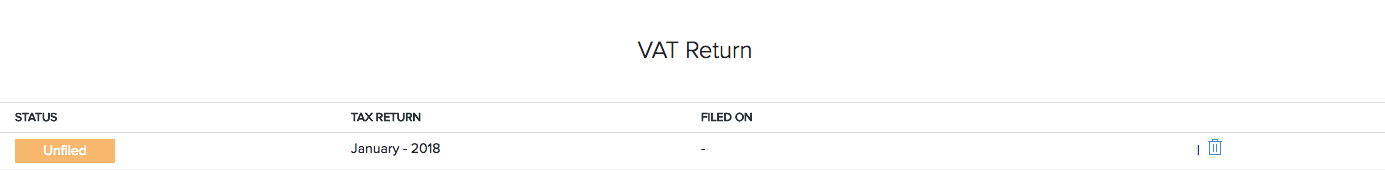

The tax returns report is a comprehensive summary of your VAT returns. This report contains a list of tax returns files which are generated for specific time periods.

The actions that you can perform in this report are:

- Generate the tax returns file

- Export/download the file

- File your tax returns

- Mark the tax returns as filed

The tax returns report generated in Zoho Books follows the standards and specifications mentioned by the FTA.

Generate the Tax Return

To generate the tax return file:

- Go to the Reports module in the left sidebar.

- Select Tax Returns under Taxes.

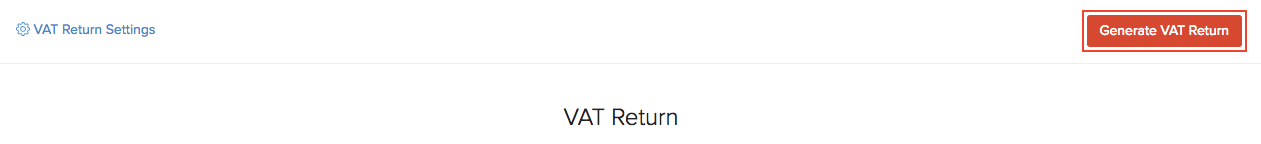

- Click Generate VAT Return in the top of the page.

View the Tax Return

To view the tax return file:

- Go to the Reports module in the left sidebar.

- Select Tax Returns under Taxes.

- Select any report that you’ve generated to view the report.

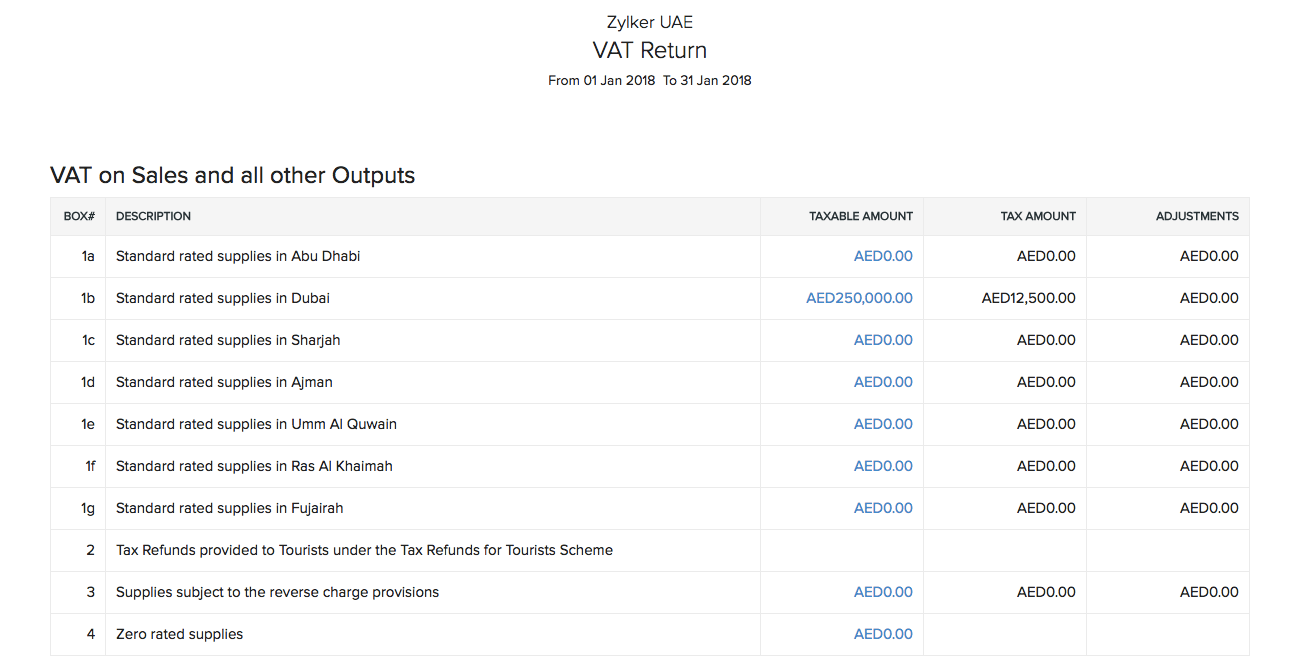

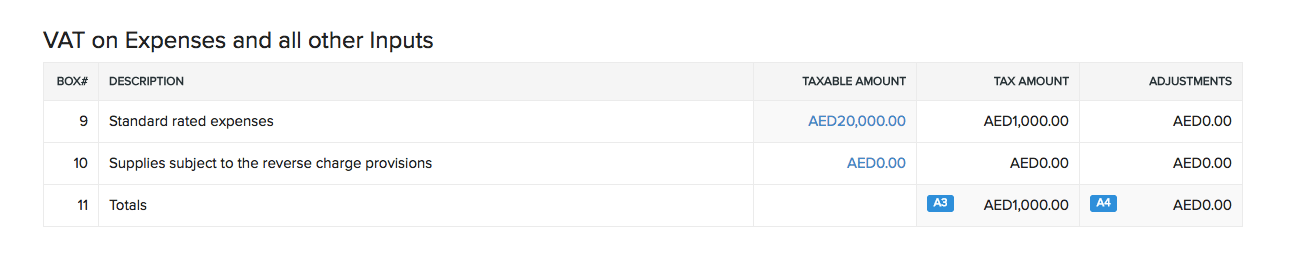

The tax return file consists of the following sections:

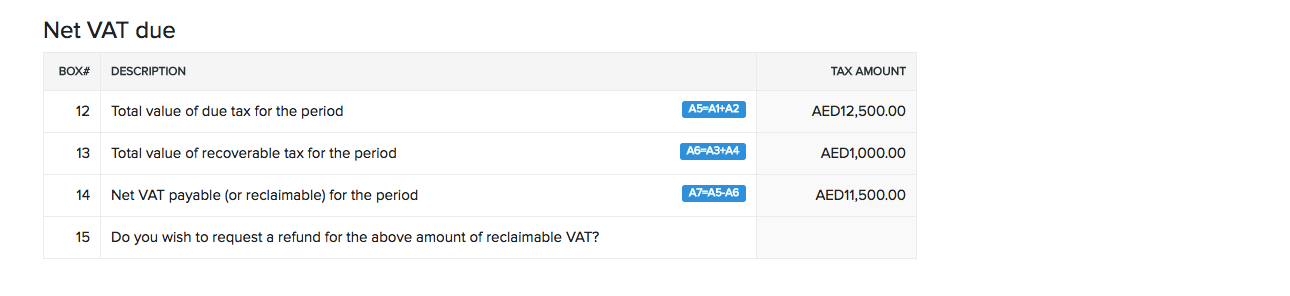

VAT on Sales and all other Outputs

VAT on Expenses and all other Inputs

Net VAT due

You can delete any tax return that you’ve generated by clicking the Delete icon next to it.

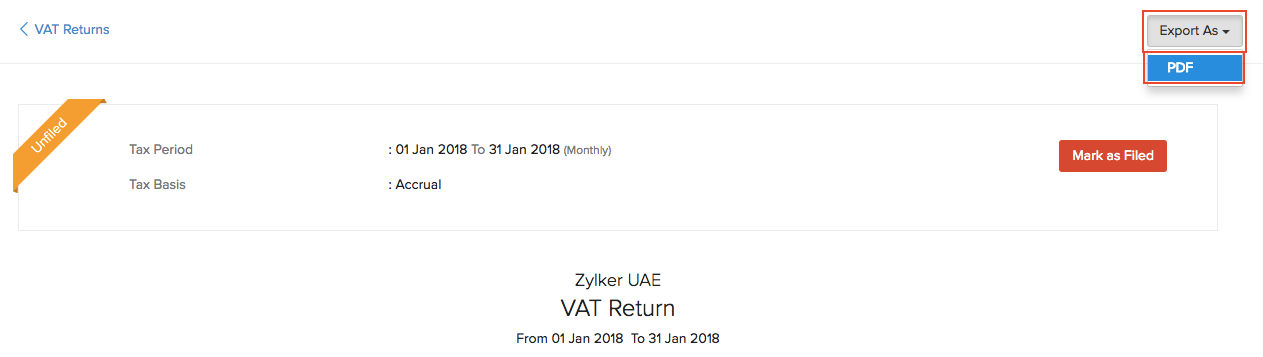

Export/Download File

You can download or export the tax return file as a PDF. Here’s how:

- Go to Reports in the left sidebar.

- Select Tax Returns under Taxes.

- Select any tax return that you’ve generated.

- Click Export As in the top right corner of the report.

- Select PDF to export the file.

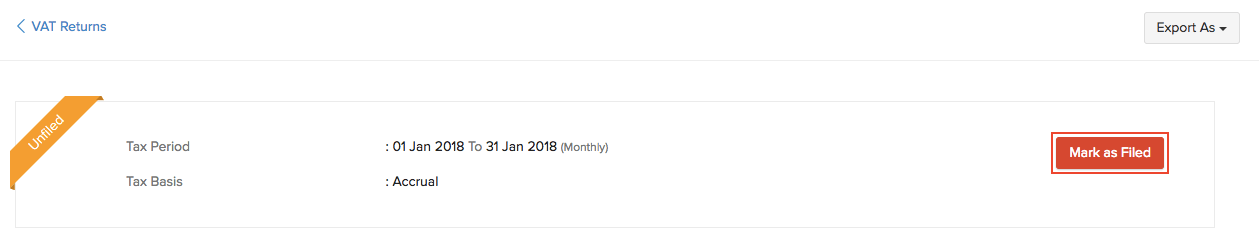

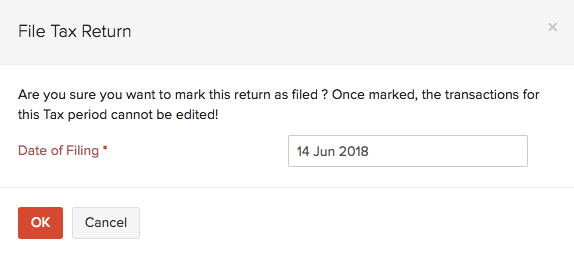

Mark the Tax Return as Filed

After you’ve downloaded and filed your tax return, you can mark it as filed in Zoho Books. Here’s how:

- Go to Reports in the left sidebar.

- Select VAT Audit Report under Taxes.

- Select any one tax return that you’ve generated.

- Select Mark as Filed in the top of the report.

- Click OK to confirm.

VAT Audit Report

The VAT audit report contains all the transactions which are carried out under VAT. It contains a list of FTA audit files which are generated for specific time periods.

The FTA has mandated this report for audit purposes i.e., to ensure that all the transactions pertaining to VAT are correctly recorded and calculated.

The VAT audit report in Zoho Books follows the standards and specifications mentioned by the FTA.

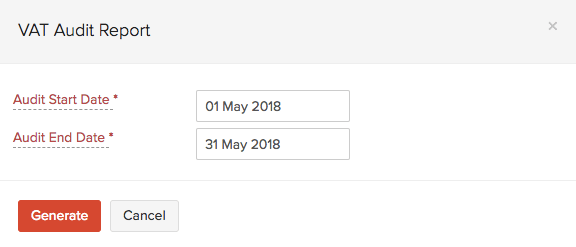

Generate VAT Audit File

You can generate a VAT audit file for a specific time period. Here’s how:

- Go to the Reports module in the left sidebar.

- Select VAT Audit Report under Taxes.

- Click Generate FTA Audit File.

- Select the time period for which you want to generate the returns, i.e., the Audit Start Date and Audit End Date.

- Click Generate.

Upon generation, an email will be sent to your registered email address. You’ll also get a notification in the Bell icon on top of your Zoho Books home page.

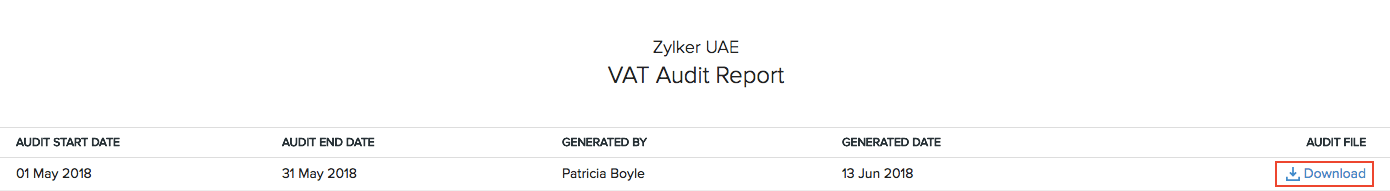

Download the VAT Audit File

After you’ve generated a VAT audit file for a specific time period, you can download it in the CSV format. Here’s how:

- Go to the Reports module in the left sidebar.

- Select VAT Audit Report under Taxes.

- Click Download next to a file which has been generated.

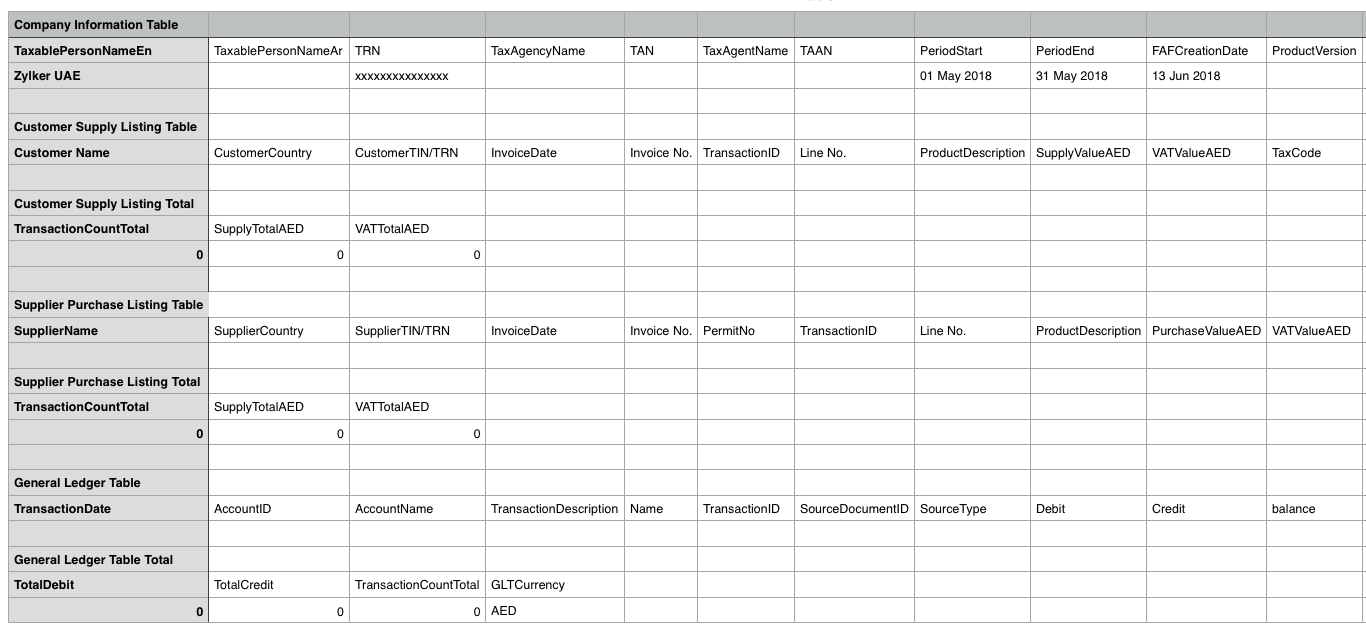

This is how a VAT audit file will look like:

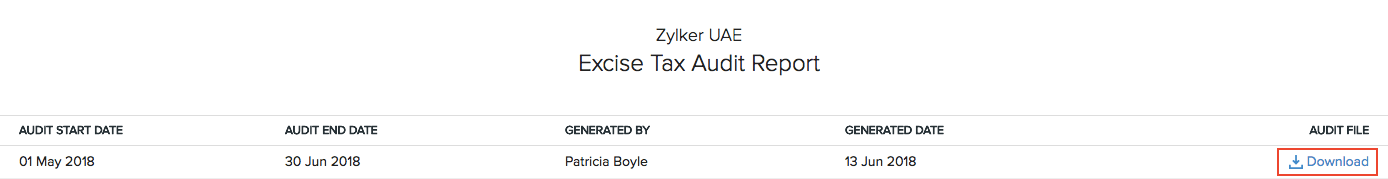

Excise Tax Audit Report

The excise tax audit report is a summary of all transactions which have excise tax in them.

This report in Zoho Books follows the standards and specifications mentioned by the FTA.

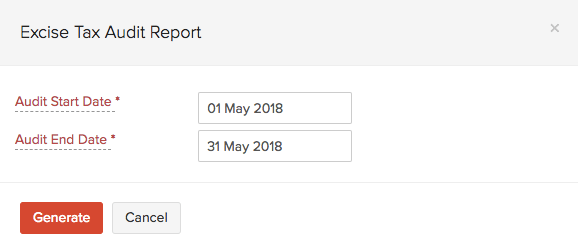

Generate the Excise Tax Audit File

You can generate a excise tax audit file for a specific time period. Here’s how:

- Go to the Reports module in the left sidebar.

- Select Excise Tax Audit Report under Taxes.

- Click Generate Excise Tax Audit File in the top right corner of the page.

- Select the time period for which you want to generate the returns, i.e., the Audit Start Date and Audit End Date.

- Click Generate.

Upon generation, an email will be sent to your registered email address. You’ll also get a notification in the Bell icon in the top of your Zoho Books home page.

Download the Excise Tax Audit File

After you’ve generated a excise tax audit file for a specific time period, you can download it in the CSV format. Here’s how:

- Go to the Reports module in the left sidebar.

- Select Excise Tax Audit Report under Taxes.

- Click Download next to a file which has already been generated.

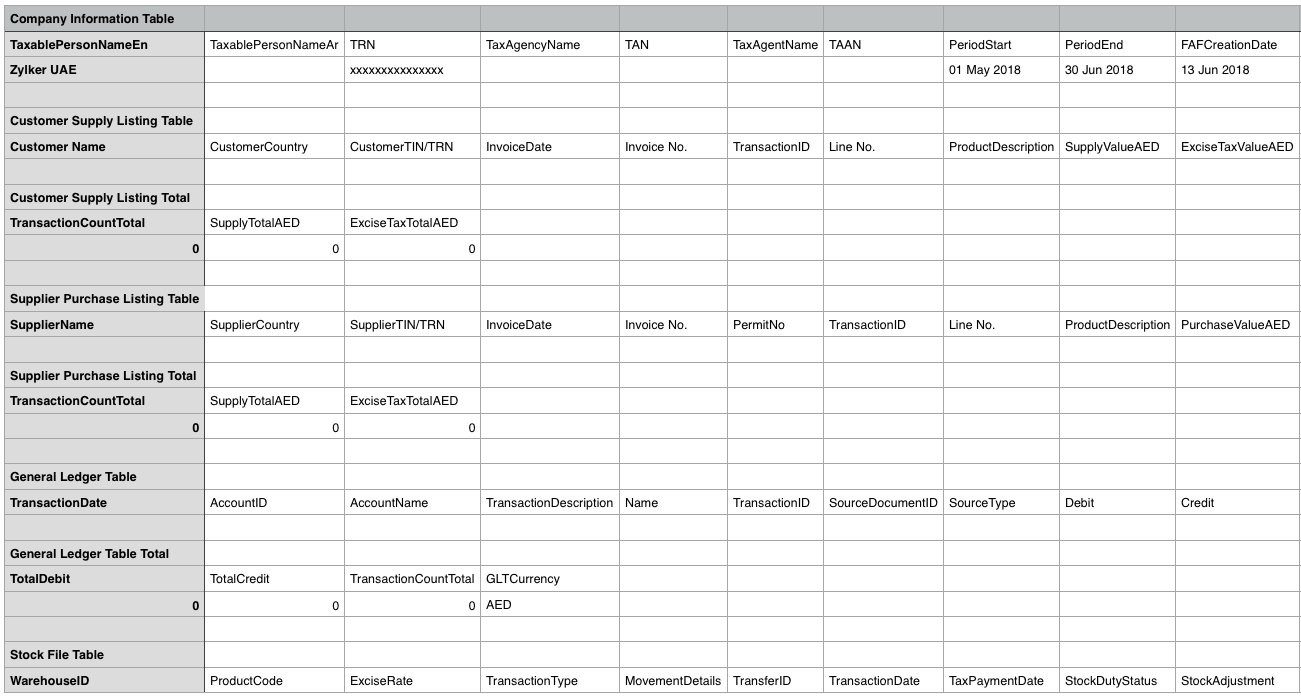

This is how an excise tax audit file will look like:

Yes

Yes