- FeaturesSee all featuresCore FeaturesEffortless Accounting

- Pricing

- SolutionsBy Size

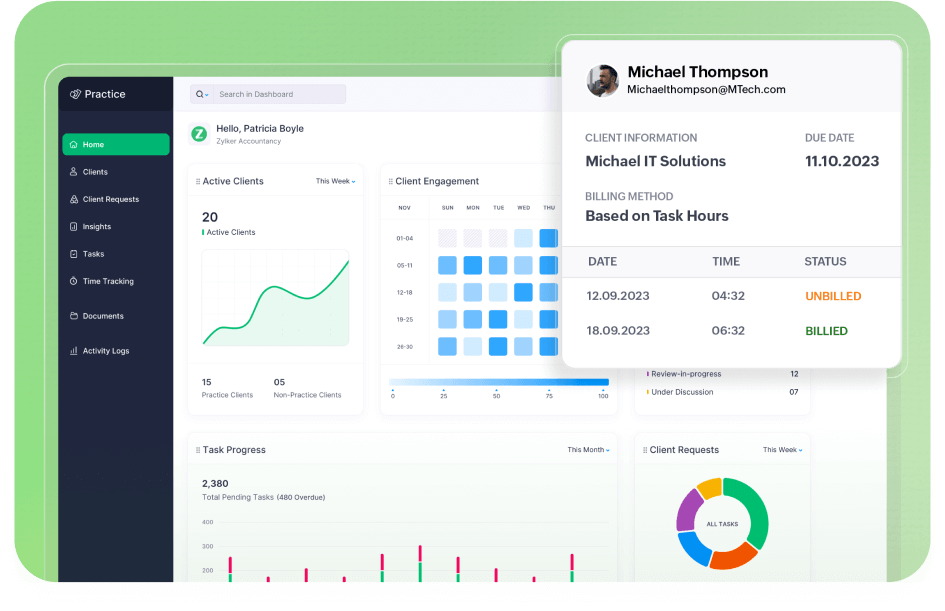

Introducing Zoho Practice

The ultimate practice management software for modern accounting and bookkeeping firms.

- Customers

- Partner with us

- Resources

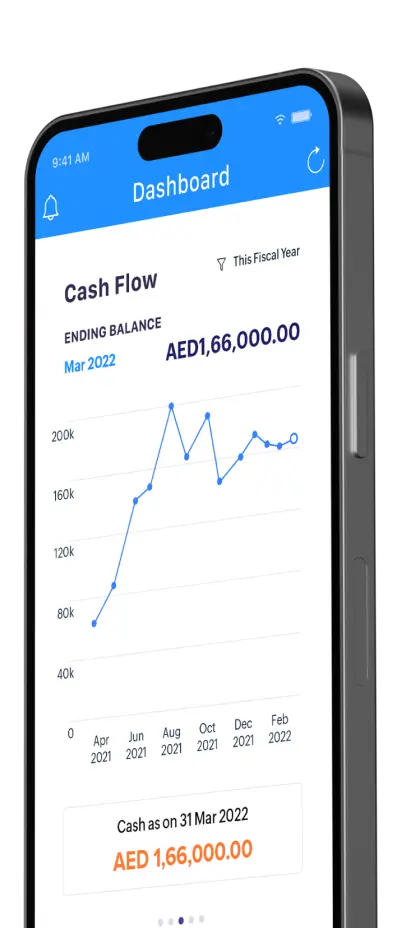

- Available on IOS

- Available on Android