- HOME

- Marketing

- A Comprehensive Guide to Market Research

- Conducting Competitor Research

Conducting Competitor Research

- 11 Mins Read

- Posted on December 5, 2019

- Last Updated on October 8, 2024

- By Lauren

While it can be split many ways, market research takes two basic forms: primary and secondary. The latter—secondary research—deals with data that already exists, and has been compiled and organized for you (we’ll get to primary research in later pages). We’re living in a world inundated with data, which means the realm of secondary research is vast: It includes public records such as market statistics, trend reports, industry content, US Census data, journal articles—even social media comments. Its sources include government agencies, chambers of commerce, labor unions, industry and trade associations, social media platforms, and more.

We’re beginning with secondary research because we think you should begin there, too. In the first place, it’s free, and can often be conducted quickly (assuming you’re clear about the questions you want answered). In the second place, secondary research is less targeted—meaning it will provide the big-picture information that’ll help you answer the broad questions early on. (You’ll learn if a market is saturated and not worth pursuing, for example.)

What’s more, secondary research yields data that might be impractical to ask your target market directly—either because they won’t know the answers (what have their purchasing trends been over the last decade?), or because the questions might make them uncomfortable (what’s their annual income?). Plus, if you begin with primary research, you may be spending unnecessary time and money collecting redundant data, identical with what already exists out there.

Competitor research (also called competitive intelligence or competitor analysis) is an invaluable form of secondary research. And it’s exactly what it sounds like: the collection and analysis of information about rival businesses.

We probably don’t have to tell you how important it is to know your competition intimately. Your business doesn’t operate in a vacuum, after all; and your prospects and customers are perpetually comparing you; so it’s crucial to see for yourself how you stack up: It’s a way of seeing your business through your customers’ eyes. Knowing your competitors allows you to better differentiate your product from the crowd, capitalize on their strengths and weaknesses, anticipate their movements and adapt quickly to their campaigns, stay ahead of industry trends, gather good ideas, and ultimately market and sell more effectively.

But first, it helps to know what “competition” includes.

Direct Versus Indirect Competition

No matter your business, you’ll likely be up against two different kinds of competition: direct and indirect.

Your direct competitors are the ones you probably think of first when you hear the word “competition.” These are the businesses who market or sell the same kinds of products or services you do—offerings that could substitute for yours. In other words, they’re the other names on your prospects’ lists when they’re considering making a purchase (your direct competitors also share your target market). Your relationship with direct competitors is typically one of mutual exclusion: If that prospect buys from your competitor, it means they won’t have bought from you.

Indirect competition, on the other hand, comes in a few forms. These are competitors who:

1) offer dissimilar products that meet the same need or solve the same problem (think eyeglasses versus contact lenses); or

2) offer a similar product to a different market segment (think Rolex versus Swatch); or

3) compete for your prospects’ attention at the level of content. These competitors may not market or sell the same products or services you do at all… but they’re using the same keywords, which means they’re your SEO competition.

In a world in which 85% of consumers use Google searches to get product ideas, you’ll want to keep a sharp eye on that last category. After all, it’s these competitors who are keeping you from rising in the search results, and keeping you invisible to searchers. As for the other two categories, you won’t devote all your energy to them; but you’ll certainly want to monitor them. After all, it would only take a single business decision (adding a new product or reaching out to a new market segment, for example) for them to suddenly become your direct competitor.

Building Your Competitor List

Before you can learn what your competitors are doing, you’ve got to know who they are. Identifying your competitors means first getting clear about the industry (or industries) you’re in and tangential to. Start with broad, high-level terms (“construction,” “food service”), and narrow it down as you go (“small renovation contractor,” “event catering”). Clarity on your “keywords” will ensure you’re reading the right industry reports and replicating the Google searches your target market uses. Here’s where to go from there:

Market reports

Organizations like Gartner and Forrester offer annual market forecasts (both free and gated) on leaders in nearly every industry. Forrester, for example, has a search feature that lets users uncover the latest industry research, using filters such as content type, methodology, region, market imperatives, and more. You’ll find out which “big guys” you’re up against here.

Google searches (“keyword research”)

You’ll absolutely want to know what websites come up for prospects when they’re searching for the solution you can offer them (i.e. “SAT tutors in Austin, TX”). Try all the variations you can imagine prospects are using. Who shows up on the first page of those SERPs? On the first three pages? Those are your competitors.

Online searches are invaluable for discovering your content competitors: You’ll find out who’s “mastered” the SEO game, and can start taking tips from them… or, better, outdo their content.

Asking your customers

Each time a customer buys from you, they’ve chosen not to buy from your competitors… though they’ve almost certainly researched and considered them. After the sale, ask your customers what other products, services, or businesses they were evaluating. You can do the same if they were in conversation with your team, and ended up not choosing you. Follow up with them: Who did they end up doing business with? Add that business to your list.

Social media

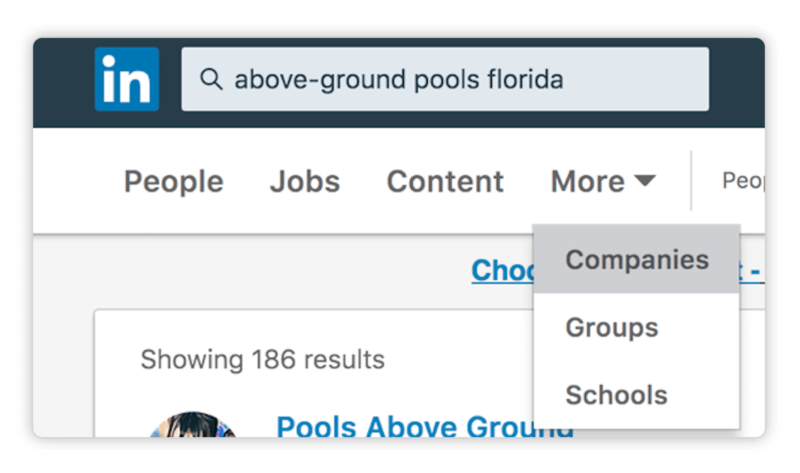

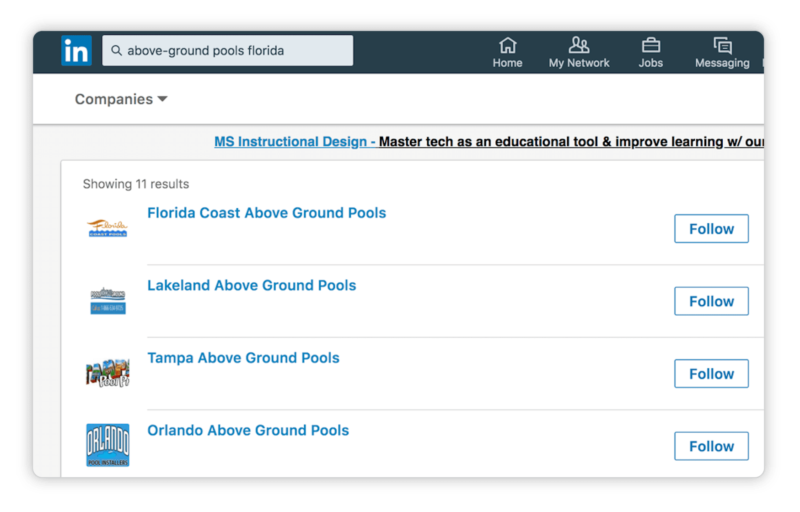

What industry-relevant information are your customers posting or sharing? What other businesses are they following and interacting with? Utilize Facebook Groups to observe which businesses are getting recommended or reviewed: When users pose questions about products or services, what businesses do group members offer as solutions? Or use the search feature on LinkedIn: Enter the name of your industry, then click the menu option for “More” and choose “Companies.” This will narrow your search to business-only results:

Community forums

Community forums

These can be as useful as social media. Consumers often head to sites such as Quora or Reddit for advice and recommendations on products and services. Employ their search features, and find out which of your competitors the hive mind is recommending… or which businesses are answering their questions.

Keeping up on your industry

This encompasses a lot: attending conferences and networking events in your industry, reading blogs, participating in online forums, joining industry-specific clubs and associations. These strategies will not only help you identify the key players in your industry; they’ll also let you know when new competitors are on the horizon.

Pro Tip: Competitors come in all sizes; but pay the closest attention to companies of a similar size and ownership structure to yours. Pay attention, too, to newer companies: While there’s a lot to learn from well-established businesses, their success may be due in part to a long history, rather than anything they’re doing remarkably well right now.

I Know Who My Competitors Are… Now How Do I Research Them?

You’ve got your list, which means half the battle’s been fought (for now). Now it’s time to find out how your competitors operate, what their apparent strategies are, their strengths and weaknesses, what their customers think of them… and as much other information as you can possibly dig up. (The fancy business term for this, by the way, is “Competitive Landscape Analysis.”)

How to do a competitor analysis? Think of it as a reconnaissance mission. Here’s where to look:

Your competitors’ websites

What does their site look like? How do they describe themselves on their About page? Can you tell how they’re positioning themselves by their value proposition, product descriptions, and the features and benefits they highlight? What are their prices? How do they justify their prices? Do they keep a blog? If so, how often do they post, what topics do they tackle, and how engaged are their readers? What other content do they offer (videos, webinars, case studies, FAQs, whitepapers, podcasts, visual content)? What’s their apparent lead generation strategy? (Do they have an email signup for example; and if so, what does it look like?) Are they cross-selling and up-selling? What do their CTAs say, and how have they mapped the buyer’s journey on their site?

This is a shortlist: There are hundreds of possible site elements to pay attention to. And don’t just look at the site; use it. Pretend you’re a new prospect who knows nothing about the company… then pretend you’re a returning customer, a job-seeker, and so on. Go through the motions of purchasing their product (or actually purchase it!) and observe how user-friendly their checkout form is. (While you’re there, pay attention to things like shipping costs, return policies, and cart practices.) Download their lead magnets. Fill out their contact form and see how long it takes them to get back to you.

All these things will be fodder for comparison. How do you stack up against what you experience as a user on their site?

You’ll want to go a little deeper into their web copy then. What’s the quality of their content? What type of content do they publish, and how frequently? How deep does it go? Introductory-level information? High-level ideas? Do they appear to have a content marketing strategy? Who writes their content? What tone does it take? What images accompany it? Is it readily available or do readers have to opt in? And then: How do their efforts compare to yours?

Your competitors’ SEO structure

While you’re at it, ask yourself if your competitors appear to have an SEO strategy. Of course, there’s no guarantee they do (though if you found them on the first page of a Google SERP, they likely do); but common language in the copy across your competitors’ websites will alert you to the topics popular with your target market.

Look at page titles, h-tags (headings), anchor text language (internal and external links), image alt text, and the content itself: What keywords (including long-tail keywords) are your competitors using? What sites are they linking to?

The answers to these questions should give you fuel for your own content efforts. Attending to comments and shares will alert you to which keywords and topics are working. Then do your research to see if there are better keywords out there (SEMrush, Google’s Keyword Planner, Ahrefs, and Moz’s Keyword Explorer are all great for this)… or ask yourself if you can write better content using the same keywords.

Your competitors’ social media profiles

Facebook, Instagram, Twitter, LinkedIn, YouTube, Pinterest, even Snapchat… check to see if your competitors have active accounts on these platforms. Then ask yourself these questions about each competitor:

Which social channels do they rely on to get their message out? What’s their overall presence like on those channels? What’s their company’s “social” tone or personality? How frequently do they post and how often do they interact with their followers? How many fans or followers do they have? What’s the engagement like? (How many people are commenting and sharing?) What are they posting? Is it original or curated content? What percentage of their posts is about their business (in other words, how is social integrated with their marketing strategy)? What web pages do they drive followers to from their profiles? What do their posts’ images look like?

Doing competitive intelligence on social will alert you to channels your competitors might be missing (and where there might be opportunities for you). It’ll help clarify what content resonates with readers, what platforms your target market is most active on, what your competitors’ apparent social media strategy is … and whether you need to step up your game.

Your competitors’ ads

Chances are that your competitors are doing most of their advertising online… but beyond where they’re doing it, pay attention to how. What product features and customer benefits do their ads highlight? Do they include promotions and special offers; and if so, what? How frequently do they advertise across channels? (If you notice a competitors’ ad in a new channel, for instance, it probably means they’re trying to reach a new market segment. Pay attention to these shifts; they’ll alert you to changing strategies.)

Feigning interest

Okay, you’re not feigning: You really are interested in your competitors. What we’re talking about here is taking the steps to become a lead… and then maybe a hot lead… and then maybe a customer. (Your user experience with their product could help you reflect upon your own).

So sign up for their newsletter, subscribe to their blog, follow them on social. Call their business with a “question” and observe their customer service. Before you place an order with them, abandon your checkout and see if you receive an abandoned cart email. Once you do place the order, pay attention to their confirmation page, how long the product takes to arrive, and how it’s packaged. If they run a brick-and-mortar store, visit it! Ask questions as though you were a prospective customer. There’s so much to learn by stepping into their prospects’ shoes.

Review sites and independent reviews

Of course, you probably have a different perspective of your competitors than their customers do; so even if you decide to “play customer,” you should also go directly to the mouths of their existing customers.

Yelp and other business review sites, social media, and Amazon (if your competitors sell there) are all great sources for discovering customer sentiment. You can find independent reviews by simply typing your competitor’s name and the word “review” into Google… or maybe your competitors allow users to leave reviews right on their website. Read them! What are people saying about their products or services? How well are your competitors filling their customers’ needs? What are their weak spots? Negative reviews might give you insight into your own opportunities—where and how you can exploit your competitors’ weaknesses.

Your sales force

You might be surprised by how much your own team knows about your competition—especially those team members who are in regular contact with your prospects and customers. Have them take notes each time a consumer mentions a competitor—about prices, contracts, problems with their offering, and so on. A regular time should be set aside in your company meetings so those team members can voice that intelligence.

Drawing Up a Competitor SWOT Analysis

We’ve already discussed SWOTsat length; so we won’t harp on them here. The point is that you should collect enough intelligence to be able to state—with certainty—what your competitors’ strengths, weaknesses, opportunities, and threats are. You’ll then be able to integrate this analysis into your own business strategy—with a much stronger idea of your advantages and disadvantages, relative to your competitors.

Remember, competitive intelligence is an ongoing process: New players will enter the market; old competitors will experience shakeups. Stay ahead of the game with tools like Google Alerts, Mention, or Zoho Social. Each of these platforms will send you alerts based on the keywords you set up to track your industry—which means getting competitor updates as they happen.

Of course, competitive intelligence isn’t the only kind of secondary research out there. You’ll want to know about target market demographics, employment rates, and consumer behavior trends, for example. In the next section, we offer an extensive list of resources to support the other facets of your secondary market research.