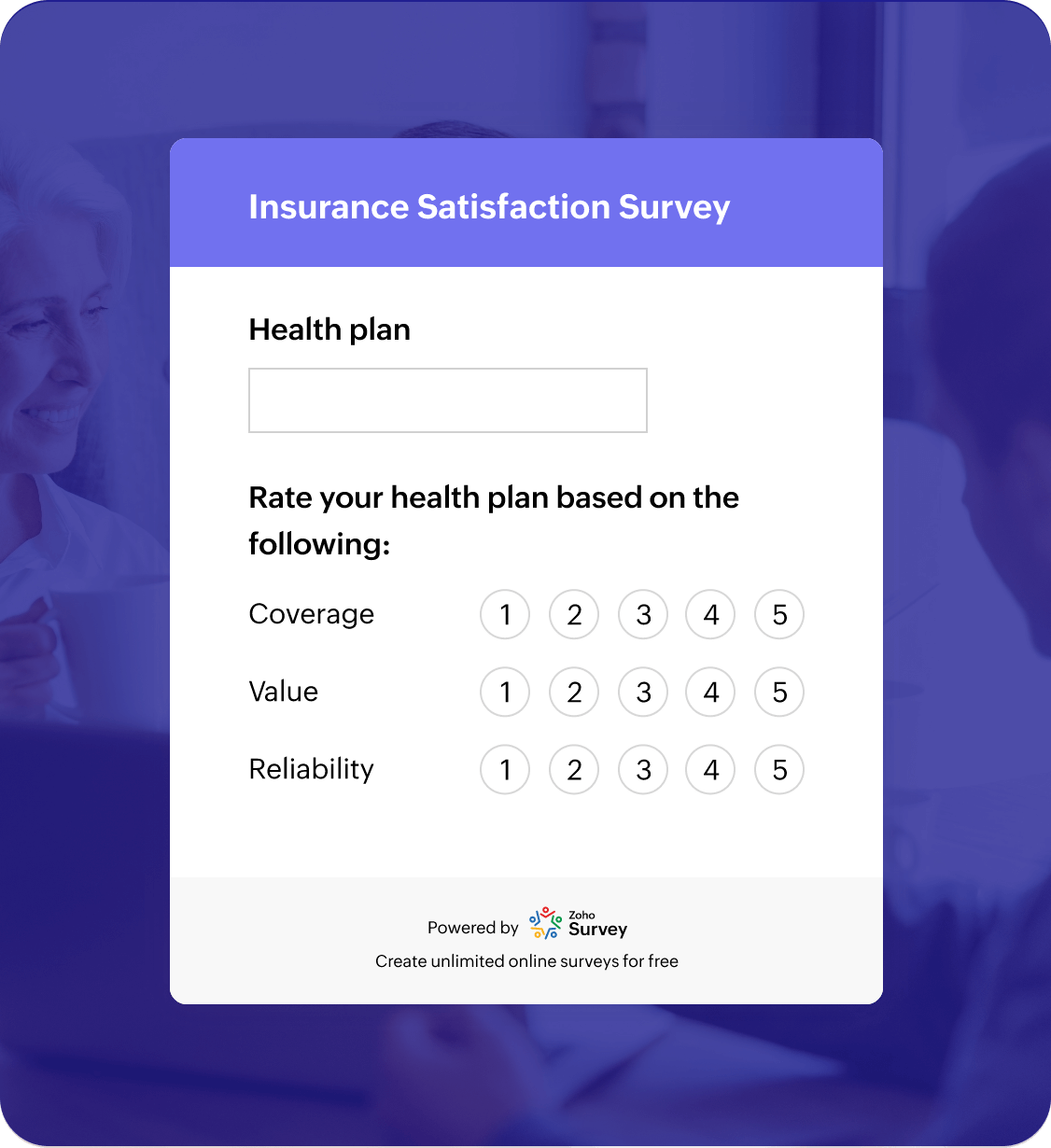

Insurance Satisfaction Survey

Insurance is an important source of help in times of crisis and loss. But your policyholders' experience is affected by a wide range of day-to-day concerns. How easy is it to apply, renew coverage, make premium payments, get information, submit claims, and collect compensation? Evaluate how your customers rate your company on these issues using our insurance satisfaction survey template.

Try this templateWhy should you consider insurance surveys?

Insurance surveys shed light on your clients' perspectives, unveiling both positive aspects and the pain points they face. By identifying shortcomings in your customer experience, you can fine-tune policies and processes, optimize staff performance, and be responsive to the issues faced by policyholders. Conducting regular surveys is a smart way to ensure you're meeting expectations and keep your business on the right track!

Insurance Satisfaction Survey

7

3200+

1min

Refine your insurance offerings with client-driven insights

Match your policies with the market's needs

Surveys provide insights into customer preferences and expectations; you can find out what your customers like and dislike about your current offerings. These insights help you tailor existing insurance products and innovate to better meet the evolving needs of policyholders.

Keep customers satisfied

Customers are more likely to stick with your company if they feel satisfied with the coverage and service you provide. Surveys help you understand what your clients need and want, allowing you to deliver positive experiences, minimize frustration, and keep your policyholders satisfied so they keep renewing their coverage and recommend your services to friends, family, and coworkers.

Boost staff performance

Use customer feedback to identify areas where your staff shines and where they can improve. You can offer targeted training and support to address issues and boost overall staff performance. Use surveys to ensure that your team is equipped to meet customer expectations.

Tap into cross-selling opportunities

Surveys can reveal other insurance products or services your customers might be interested in. You can use this information to offer bundled packages or complementary policies to existing customers. This gives you a chance to provide additional coverage they might find valuable—and increase your company's revenue.

Identify and rectify shortcomings

Surveys reveal aspects of your services that frustrate or inconvenience your customers. Taking prompt action to address these concerns helps strengthen your relationships with customers, enhances their satisfaction, and encourages them to consider purchasing additional policies.