Account Balance

The Account Balance is the total amount of funds in your account, including all available, reserved, and future payouts. The account balance section provides an overview of your complete financial standing within your Zoho Payments account.

To view the account balance:

-

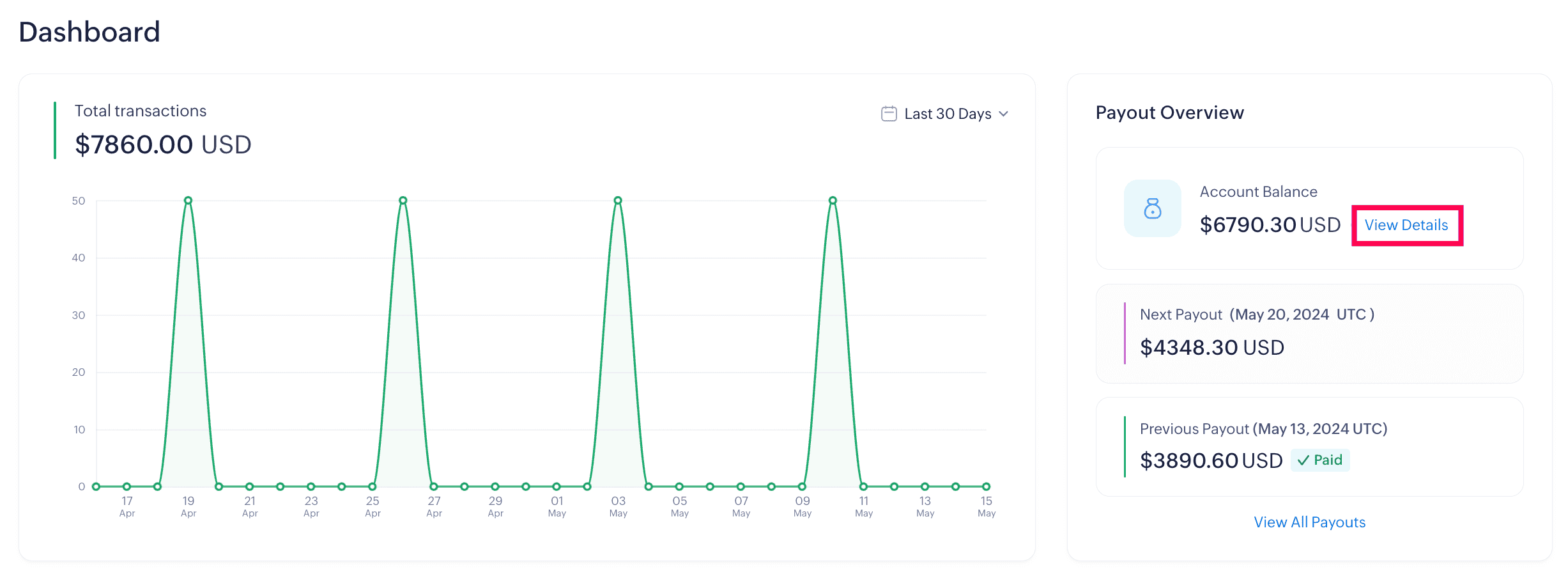

Go to the Dashboard and navigate to the Payout Overview section.

-

Click View Details near Account Balance.

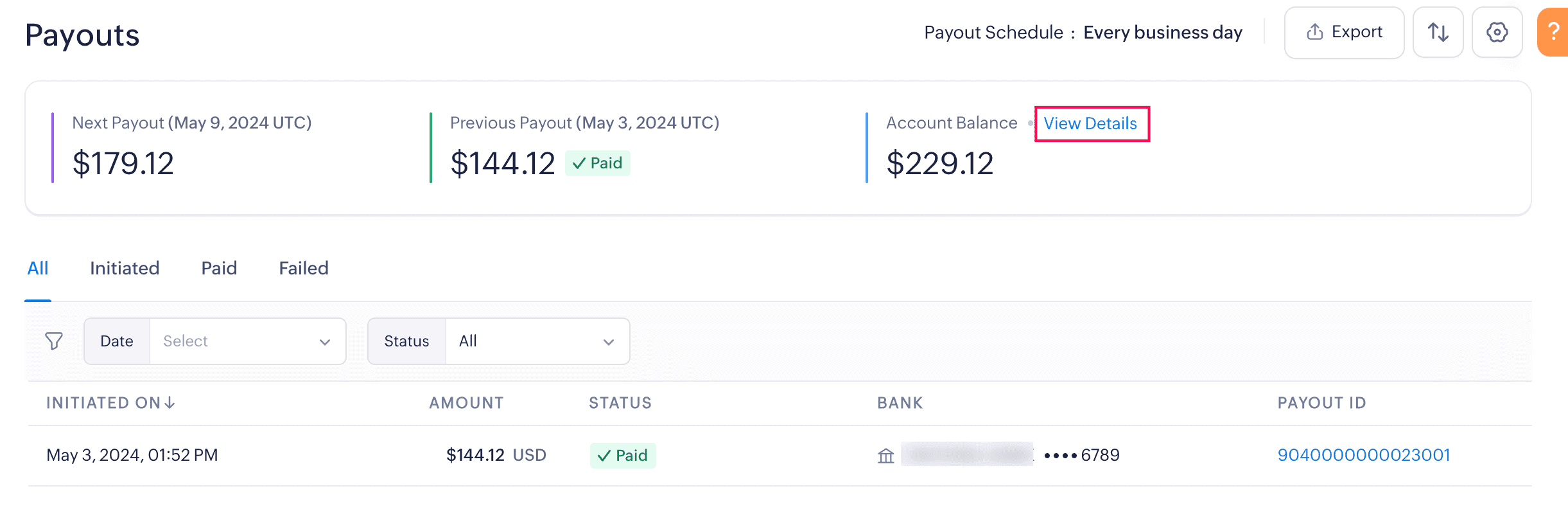

Alternatively, navigate to Payouts and click View Details near Account Balance.

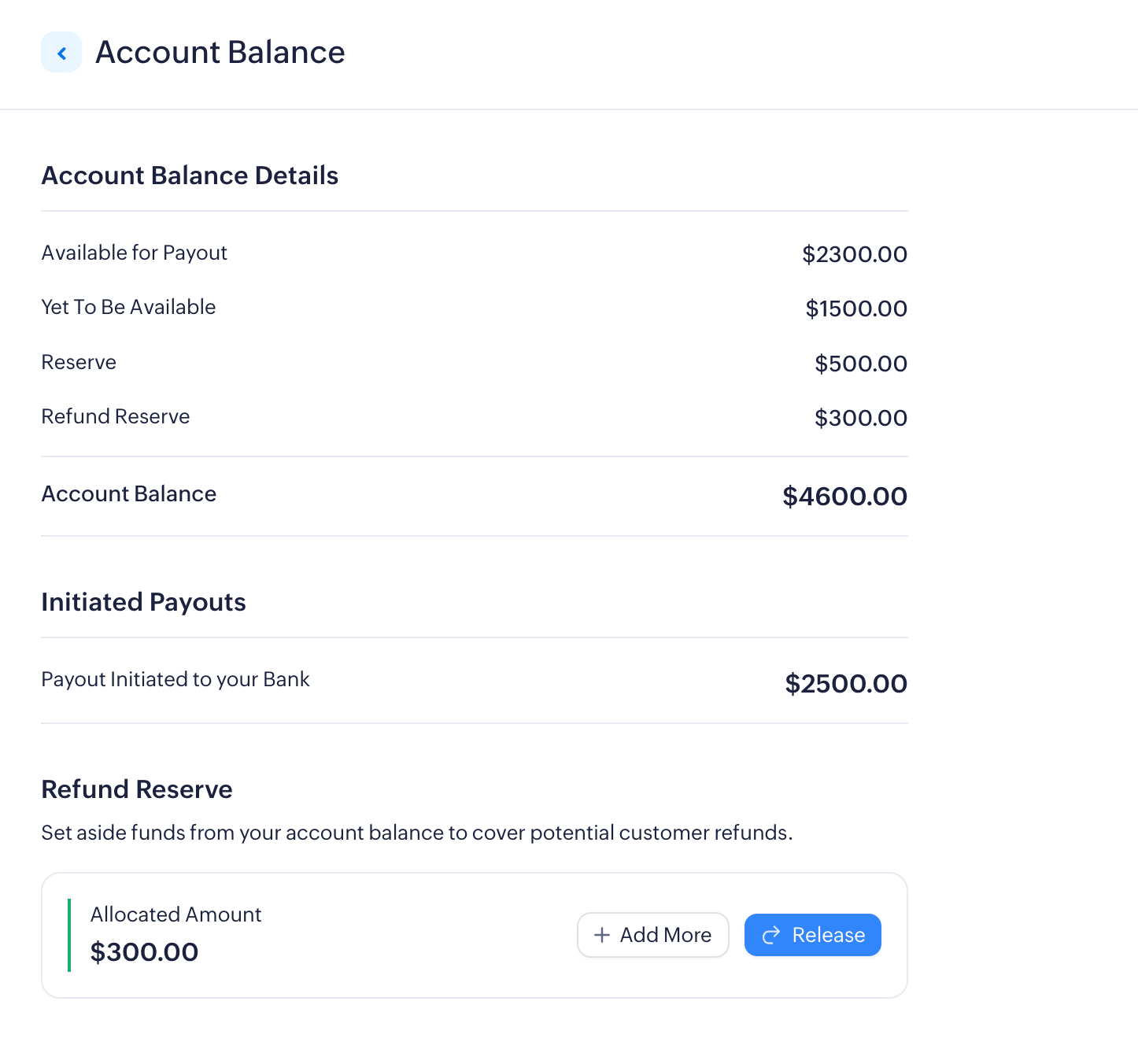

The Account Balance page has the following sections:

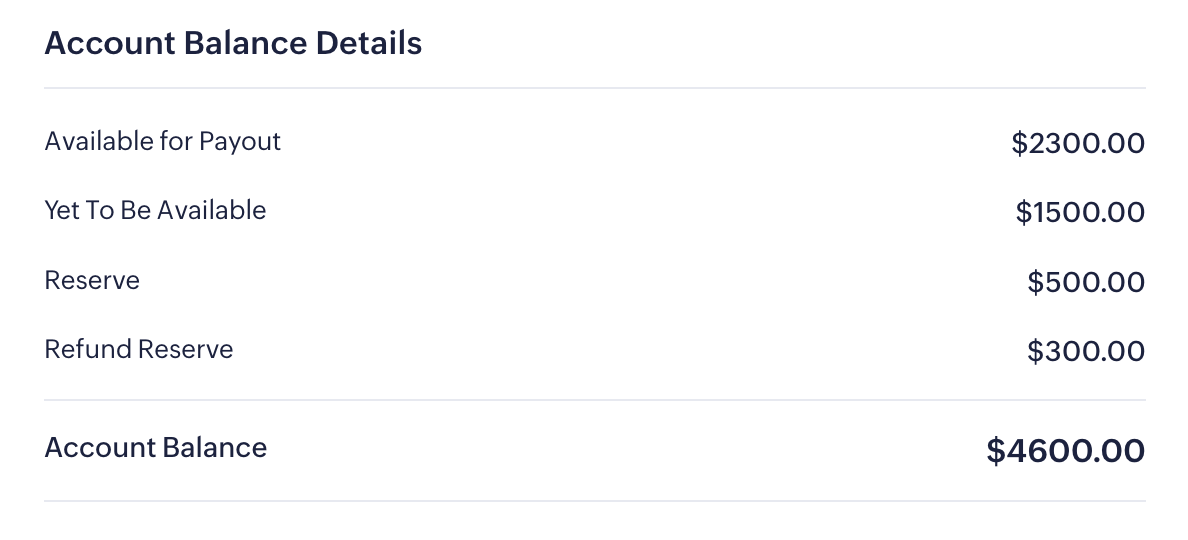

Account Balance Details

The account balance displayed is made up of the following elements:

Available for Payout

The actual amount available for payout after deducting adjustments and refunds that can be deposited to your configured bank account.

Yet to Be Available

Payments that have been processed via Zoho Payments but are yet to be made available for payout. These payments will be available in T+ 2 business days (this can vary based on the nature of your business). T here denotes the actual transaction date.

Reserve

Zoho Payments sets aside a reserve to cover potential disputes and losses. The reserved fund provides a safety net to manage risks associated with payment processing. Read more about reserves.

Refund Reserve

Funds set aside by businesses to address potential disputes and refund requests. Read in detail about allocating and managing the refund reserves.

Initiated Payouts

The payout amount that has been initiated to your bank account.

Reserves

Reserves are amounts temporarily withheld by Zoho Payments to cover disputes and mitigate losses for your business and customers.

Sometimes, when a customer has disputed a transaction, there might not be sufficient funds in your account to process a chargeback. In such a case, Zoho Payments will need to withdraw funds from your account to settle the initiated chargeback.

The reserve amount and the holding period are determined by assessing your business risks and the incurred disputes.

Note: The holding period may be extended or reduced at the discretion of Zoho Payments. Please contact support for more details.

To view the reserve amount:

- Go to the Dashboard and navigate to the Payout Overview section.

- Select View Details near Account Balance.

The reserve amount will be listed along with your account balance.

Types of Reserves

Zoho Payments can set aside two types of reserves.

Flat Reserve: A portion of your balance will be held by Zoho Payments as a reserve.

Let’s say you have $1000 dollars available in your account, Zoho Payments might set aside $100 as a reserve and release it at the end of the holding period.

Rolling Reserve: A percentage of each transaction is withheld by Zoho Payments.

Let’s assume you receive a $1000 payment, Zoho Payments reserves 10% ($100) from it, and the remaining $900 will be released for payout, while steadily building up the reserve over time.

Zoho Payments will release the reserve once the holding period ends.

Insight: Apart from the above, in case of a withdrawal, the withdrawn amount will be held as a reserve for the next T+[4] business days (depending on the nature of the business). The funds will be released upon confirmation of withdrawal.

Refund Reserve

A refund reserve is an amount that businesses can set aside to manage potential refunds and other payment-related expenses. It ensures the business has sufficient funds at all times to manage sudden customer requests.

Note: These are different from the regular reserves by Zoho Payments.

You can set up a reserve and allocate any amount towards your refund reserve. After allocation, your payments will first contribute towards this fund, and the payments exceeding this fund will be settled in your account. If a portion of the refund reserve is used for a refund, the next incoming payment will replenish that portion. Only the amount exceeding the refund reserve will be available for payout.

Scenario:

Let’s say you set $1000 as your fund. Any incoming payments will contribute towards this fund before becoming available for payout in the usual settlement cycle. Once the fund reaches $1000, any additional payments exceeding this amount will be made available for payout. This ensures that your account remains adequately funded.

When your next payout is settled, this fund amount of $1000 will remain reserved and will not be settled. Now, if a refund or chargeback is requested after a payout, let’s say a refund of $200, you can use these funds to settle your customer promptly. The next payment you receive will automatically replenish the reserve, maintaining the total at $1000. You don’t need to add the $200 back to the reserve manually.

If you need funds, you can release them anytime. The amount will then immediately become available for payout as per your schedule.

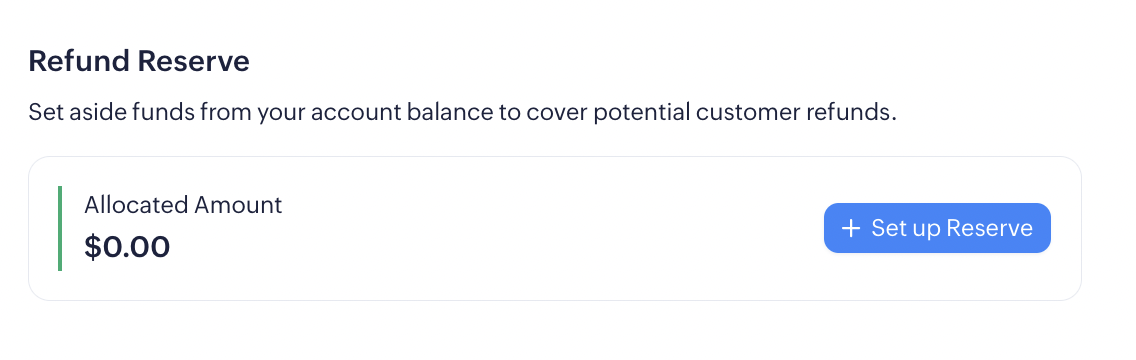

Create Refund Reserve

To create a refund reserve:

-

Go to the Dashboard and navigate to the Payout Overview section.

-

Click View Details near Account Balance.

-

Scroll down to the Refund Reserve section.

-

Click Set up Reserve and enter the amount in the following pop-up.

Insight: You can enter any amount based on your business’s needs. There’s no limit on the minimum and maximum amount.

- Click Confirm.

The amount will be set aside from your balance towards the refund reserve. You can allocate additional funds as well later by clicking Add More.

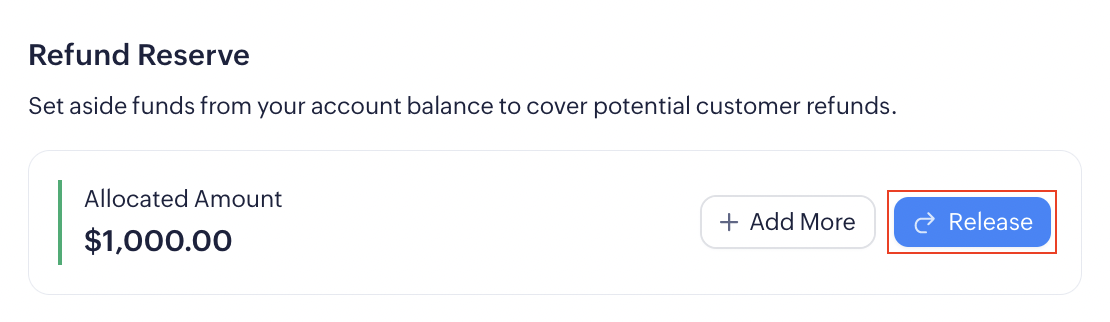

Release Refund Reserve

To release the refund reserve anytime:

-

Scroll down to the Refund Reserve section.

-

Click Release.

-

Enter the amount to be released or click Release All Reserves if you’d like to release the entire amount.

-

Click Confirm.

The amount will be made available for payout immediately.