Setting Up Zoho Payments

Setting up your Zoho Payments account is an easy and straightforward process. Read on to know how to create your account.

Note: Zoho Payments is currently in early access and is available only to a few existing users of Zoho Finance applications (Zoho Books, Zoho Invoice, Zoho Inventory, Zoho Billing, and Zoho Checkout). If you are a Zoho Finance app user and you would like to access Zoho Payments, please drop us a line at support@zohopay.com.

Prerequisites

Before you get started with Zoho Payments, here’s what you’ll need:

- A device with a stable internet connection and the latest web browser.

- A Checking account in a bank of your choice whose base currency is USD.

- The basic details of your business (registered in the U.S.).

- The details of the business owners and an authorized personnel (business representative).

Note: Zoho Payments is currently available only for businesses in the United States.

Create a Zoho Payments Account

Create an account with Zoho Payments to start collecting online payments from customers. You’ll only need to do this once and enable it in your business application.

To create a new account:

-

Go to one of your Zoho Finance organizations. This can be a Zoho Books, Zoho Invoice, Zoho Inventory, Zoho Billing, or Zoho Checkout organization.

-

Go to Settings > Online Payments.

-

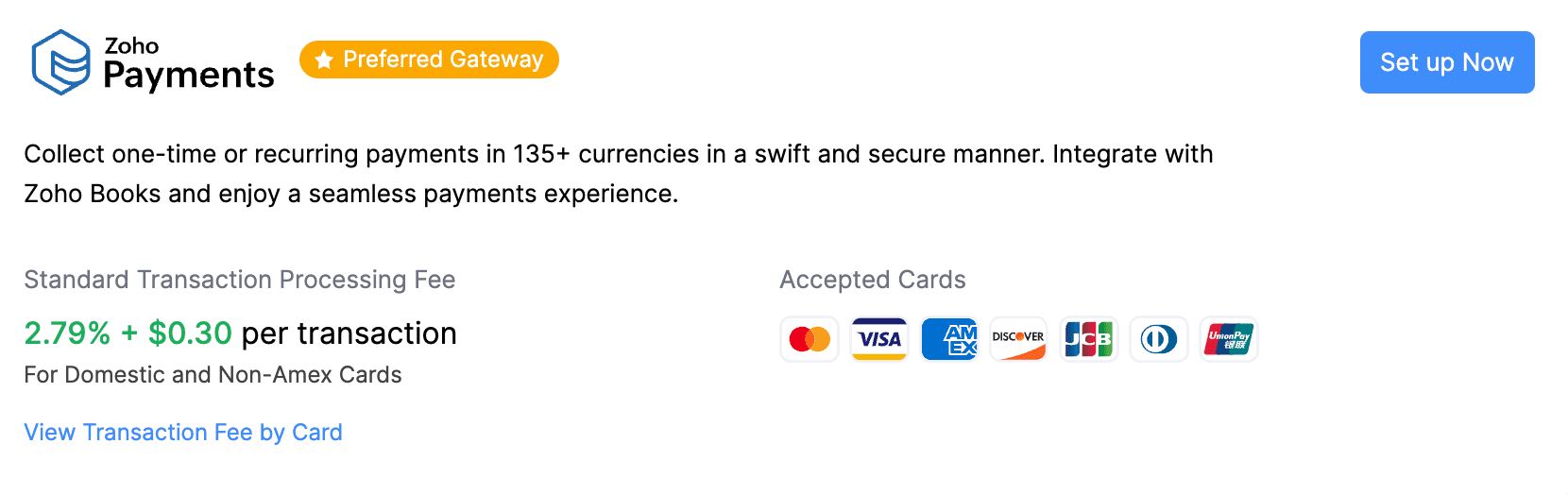

Go to the Customer Payments section, where Zoho Payments will be listed as the Preferred Gateway.

-

Fill in the details in the sections to get started. Most of them are basic business details which a legally authorized representative should have access to. If you’re not sure what they are or where to get them, please read below.

- Business Profile

- Business Representative

- Business Owners

- Branding and Public Information

- Bank Account

Read and accept the terms and conditions, and a new Zoho Payments account will be created.

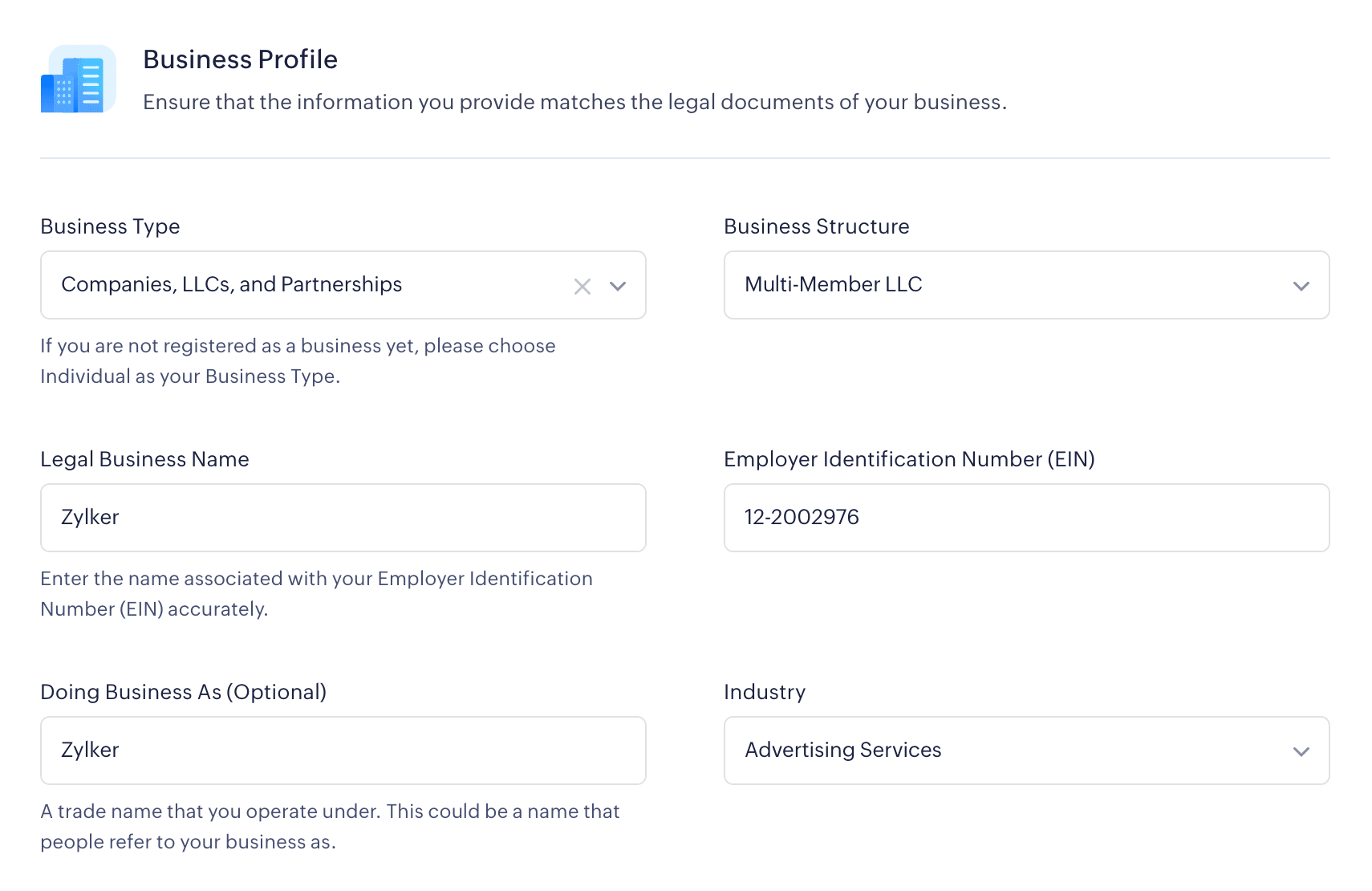

Business Profile

Enter the basic details of your registered business in this section. Ensure that the details you provide here match your legal documents. This section has the following fields:

Business Type

Tell us if your Business Type is Individual, Companies, LLCs, Partnerships, or Nonprofits. Depending on the business type you’ve chosen, the information we collect for creating and verifying your Zoho Payments account will vary.

Insight: If your business is not registered yet, the Business Type will be Individual.

Warning: Ensure you provide the correct details as you cannot change this setting from the application once you create your account. You can contact support@zohopay.com if you want to change your business type and initiate the verification process once again.

Business Structure

The Business Structure influences the regular business operations on how it is regulated, taxed, and much more. The following are the supported business structures for each business type:

| Business Type | Supported Business Structures |

|---|---|

| Individuals | Not Applicable |

| Companies, LLCs, and Partnerships | Sole Proprietorship, Private Corporation, Single-member LLC, Multi-member LLC, Private Partnership. |

| Nonprofits | Not Applicable |

Legal Business Name

The registered business name that’s used in all your official communications, documents, tax returns, etc.

Note: If you are a registered entity, ensure that you enter your Legal Business Name and not the trade name or the business name that’s commonly used to identify your business.

Employer Identification Number (EIN)

The Employer Identification Number (EIN) is a unique 9-digit number assigned by the IRS to the businesses operating in the United States. This number is usually used to identify your business for tax purposes.

Insight: The EIN is also known as the Federal Tax Identification Number, Tax ID number, or 95 Number. If you don’t have an EIN yet, you can apply it online on the IRS website.

Pro Tip: If you use your Social Security Number (SSN) for filing your taxes and other official purposes, you can enter that instead.

Doing Business As

The name that’s commonly used to identify your business.

Industry

The industry under which your business falls.

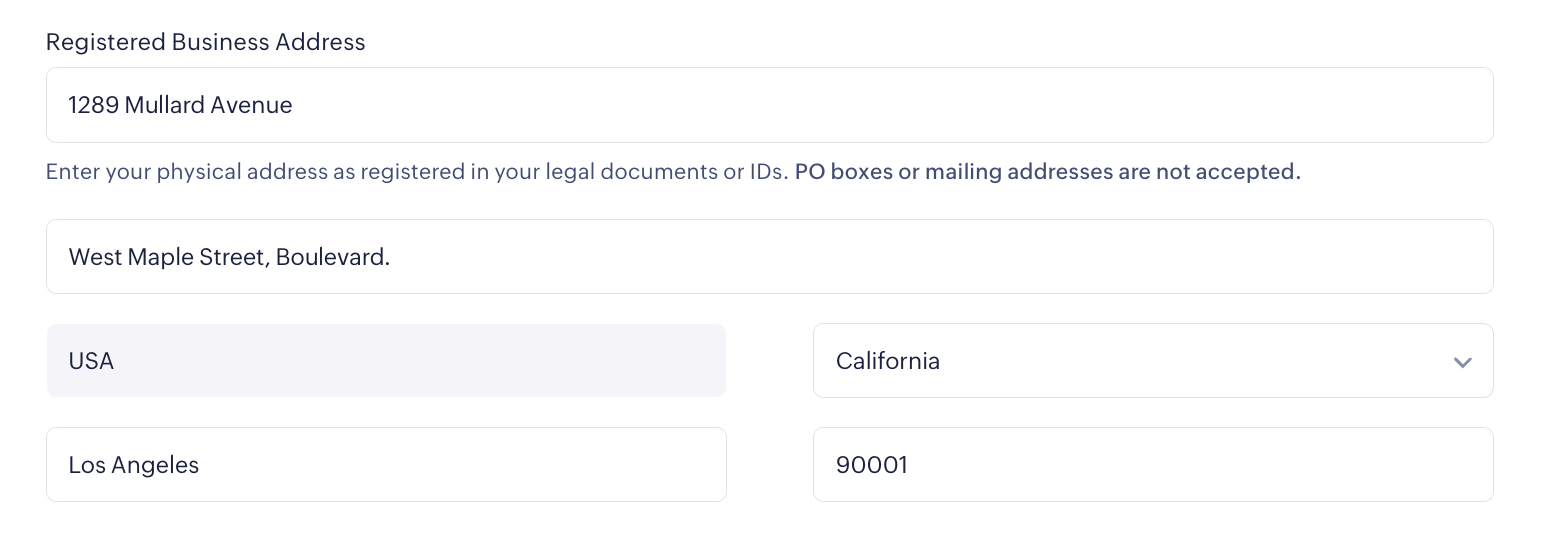

Registered Business Address

The officially registered physical location of your business. This address is the same as what you’ve provided in your EIN and is used for official correspondence. Enter your complete address including the Address Line 1 and 2, City, State, and ZIP Code.

Note: Ensure the business address you’ve provided is in the U.S.

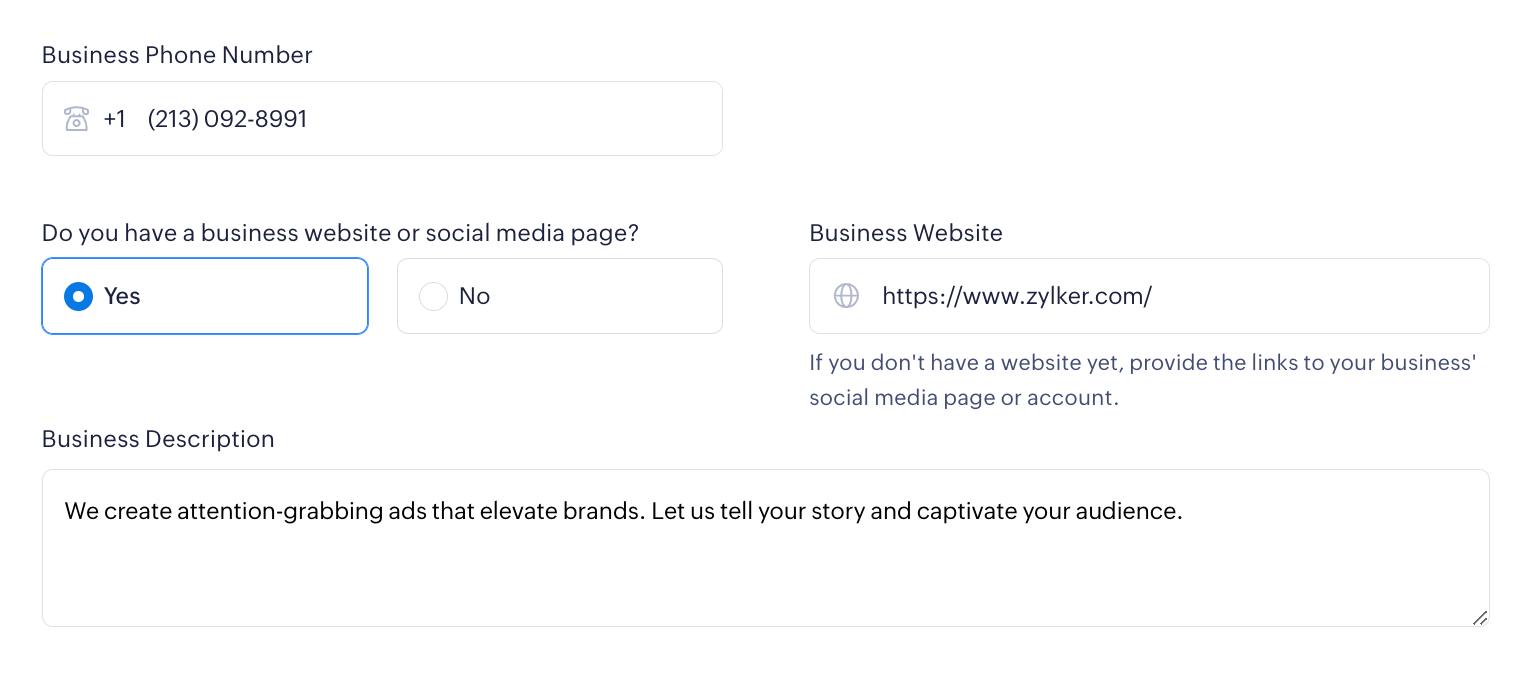

Business Phone Number

The registered phone number used for business communication.

Business Description

Provide a brief description of the nature of your business, what you do and anything else you’d like us to know about your business operations.

Business Website

Provide your website’s link or a link to your business' social media page.

Payment and Fulfillment Details

Zoho Payments collects information on the products you sell, volume of transactions, and delivery details to gain insights into your business operations.

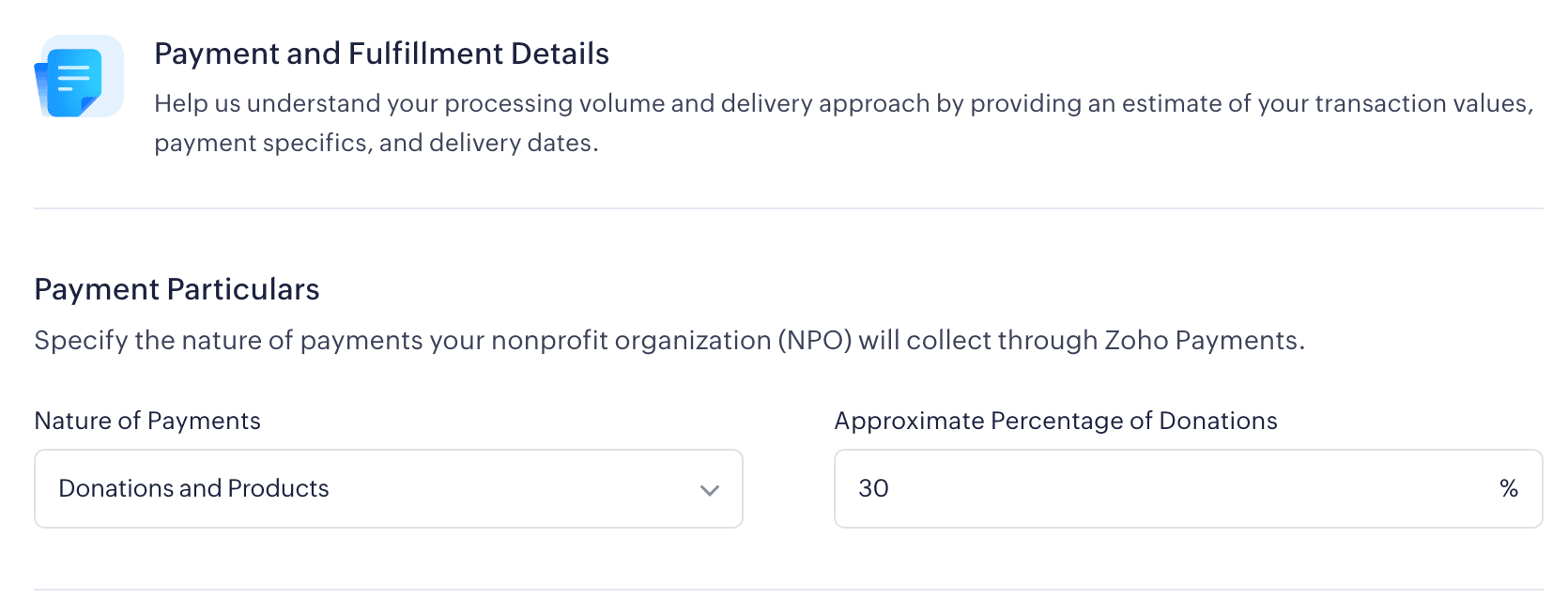

Payment Particulars

Note: This section is applicable only to those who’ve chosen Nonprofit as their Business Type.

Specify the type of payment your organization will collect through Zoho Payments. This helps us understand the nature of the funds you receive.

Select whether the payments are processed for Products, Donations, or Products and Donations from the drop-down menu.

If your NPO accepts payments for donations and products, specify the Approximate Percentage of Donations received.

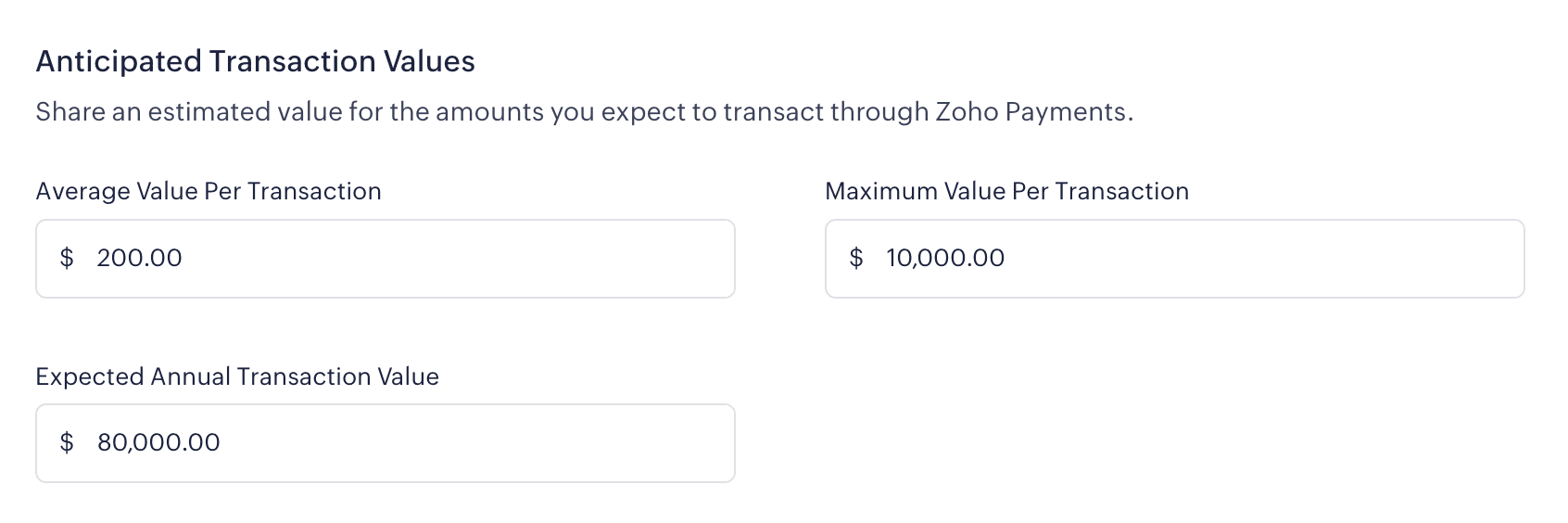

Anticipated Transaction Values

Tell us approximately how much you plan to process through Zoho Payments. This provides an insight into your expected usage of the platform.

Average Value Per Transaction

Specify the average amount per transaction you intend to collect using Zoho Payments.

Maximum Value Per Transaction

Enter the maximum amount you expect to receive in a single transaction through Zoho Payments.

Expected Annual Transaction Value

Provide the anticipated total transaction amount you will process through Zoho Payments annually.

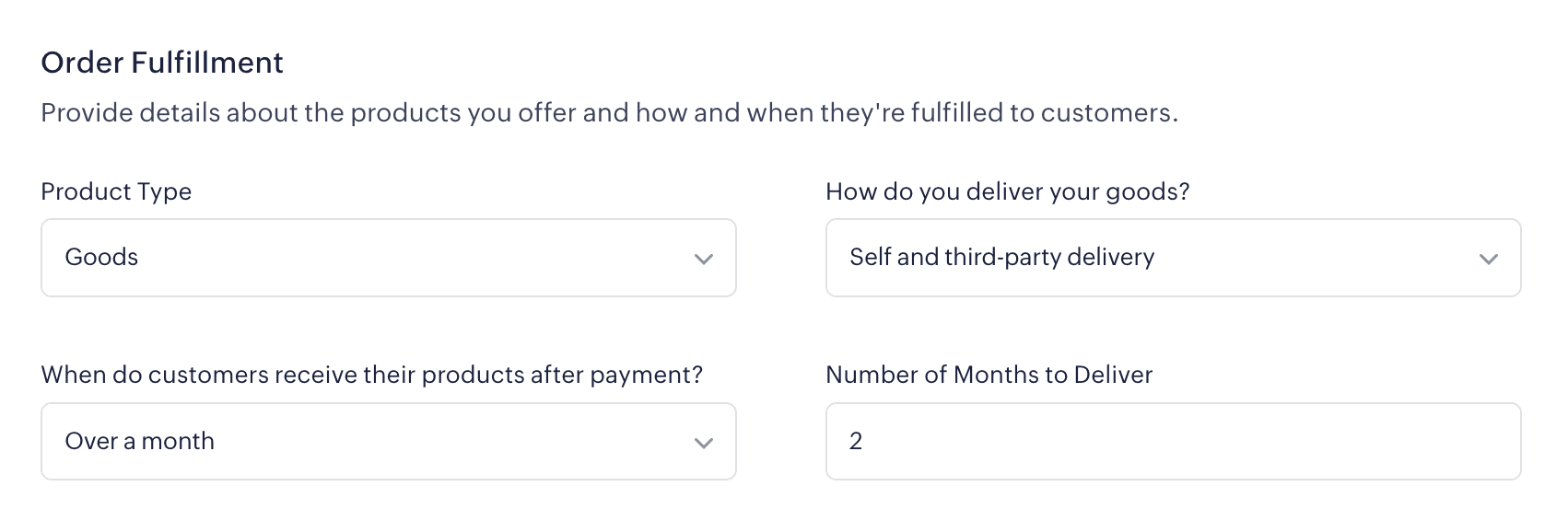

Order Fulfillment

In this section, provide details about the products you offer, including how and when you deliver them to your customers. This will help us understand the product range and the delivery timeline.

Product Type

Choose the product type you offer. This could be:

- Goods

- Services

- Goods and Services

How do you deliver your goods?

Specify your preferred method of delivery to transport your goods to the customer, such as:

- Self-delivery

- Third-party delivery

- Self and third-party delivery

Time taken to deliver

Select the time taken to deliver the product to the customer after the payment is completed.

Note: For product deliveries exceeding one month, specify the number of months to deliver.

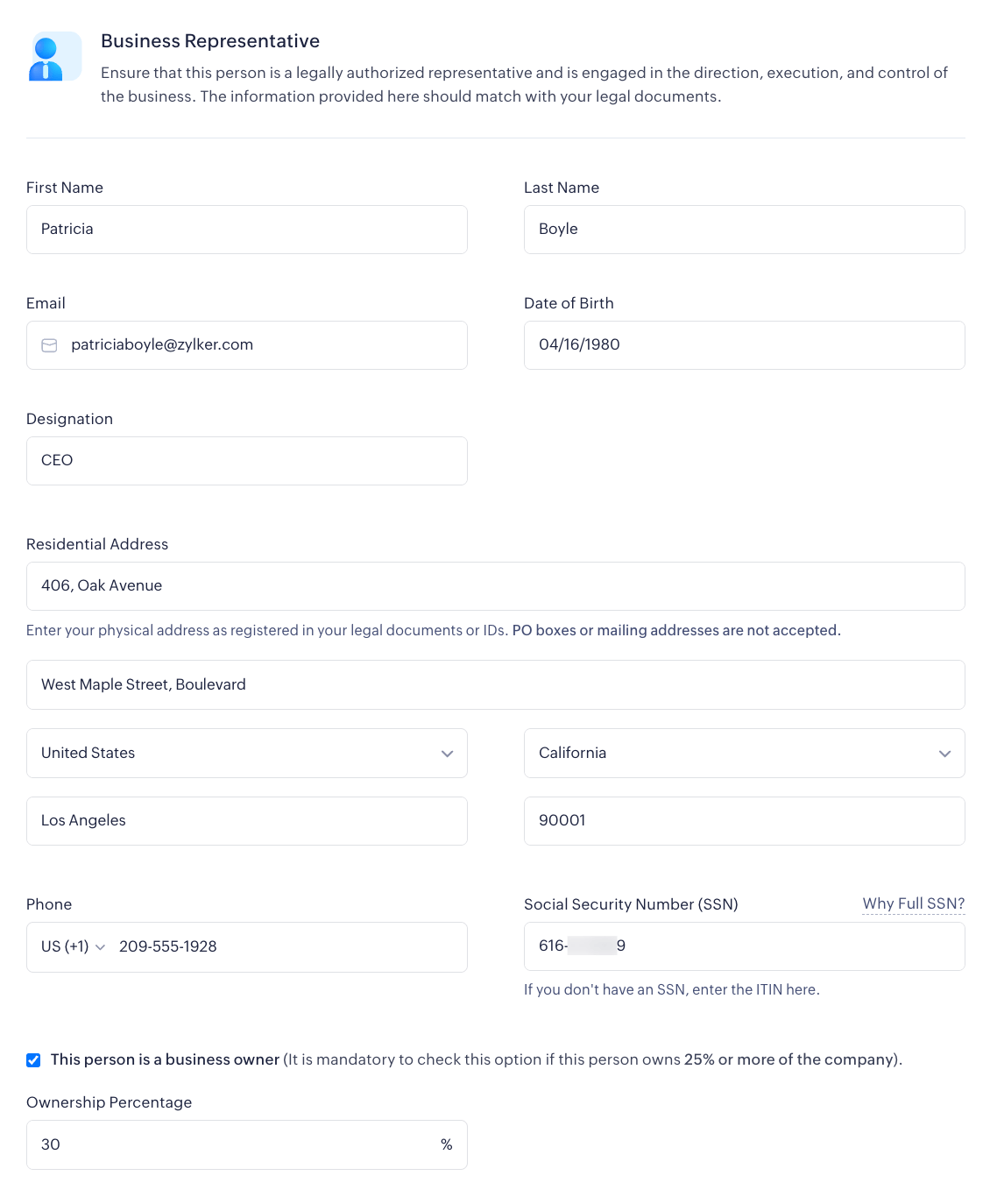

Business Representative

A business representative is usually the user who creates and accesses the Zoho Payments account. The representative should be an authorized person who is engaged in the direction and control of the business.

Insight: If the business owned and controlled only by a single person, i.e., the business type is Individual, Sole Proprietorship or Single Member LLC, then provide the details of the owner.

Ensure you provide the following details of the representative as stated in their legal documents:

- First and Last Name

- Email Address and Phone

- Date of Birth

- Last 4 digits of the Social Security Number (SSN) - The 9-digit identifier assigned by the government to the U.S. citizens and eligible residents to track their earnings and social security benefits.

- Designation - This tells your role and relationship with the business.

- Residential Address

- Ownership Percentage - If the business representative is also the business owner, check the option This person is a business owner and enter the ownership percentage.

Note: It is mandatory to check this option if this representative owns 25% or more of the company’s share.

Business Owners

Note: This section is applicable only for those who’ve chosen Companies, LLCs, and Partnerships as their Business Type.

Provide the details of users who hold significant ownership in your business. If the business representative is also a business owner, the details for one owner will be automatically populated.

Enter the following details as stated in all legal documents:

- First and Last Name

- Email Address and Phone

- Ownership Percentage (It is mandatory to provide the details of businesses who own more than 25% of the business.)

You can add more owners by clicking + Add Another Owner and remove owners by clicking Remove near the owner details.

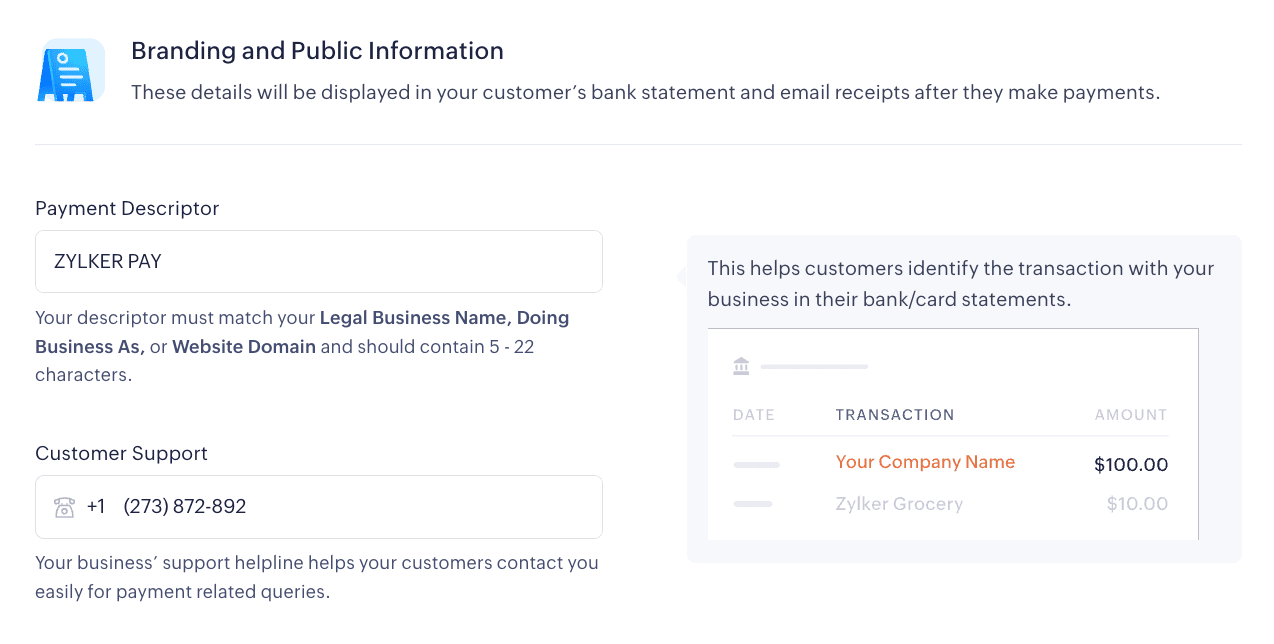

Branding and Public Information

This section displays the details that are visible to all your customers in their transaction receipts and bank statements.

Payment Descriptor

A Payment Descriptor (sometimes known as a statement descriptor) is the name that helps customers identify the transaction with your business (their payment to you) in their bank/card statements.

The statement descriptor you create must match your Legal Business Name, Doing Business As, or Website Domain name with your Payment Descriptor.

Insight: The descriptor can have 5-22 alphanumeric characters, and cannot contain the special characters such as <, >, \, ‘, “, *.

Customer Support

Provide a support helpline that customers can use to contact you. This detail will be included in the emails sent to your customers.

Bank Account

In this section, provide your bank account details so Zoho Payments can use them to deposit your payouts. Make sure that the bank account you add is a checking account. You can choose to:

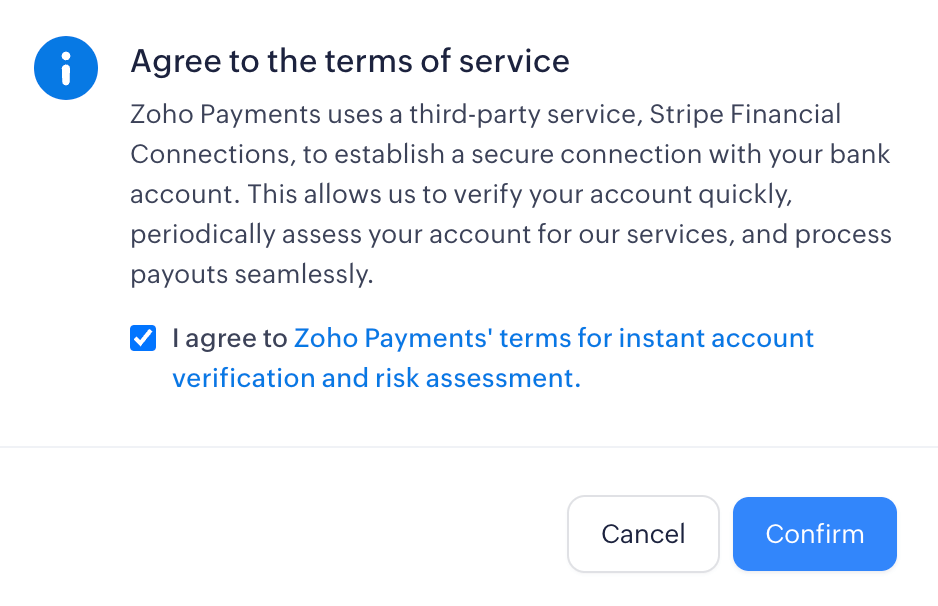

Connect your bank account to Zoho Payments

You can connect your bank account with Zoho Payments in a secure manner. Connecting your account allows us to verify your bank account quickly and process payouts faster.

Insight: Zoho Payments uses a third-party service, Stripe Financial Connections, to establish a secure connection with your bank account. Connecting your account expedites the verification process and allows us to assess your account for our services periodically.

To connect your bank account:

-

Click Connect Now.

-

Read and agree to the terms for instant account verification and risk assessment and click Confirm to proceed.

- Click Agree and continue in the page that follows to connect your account.

- Search and select your bank in the pop-up. Based on the bank, you will be able to enter your banking credentials, or you will be taken to the bank’s portal to connect your account.

- Sign in to your account and select the bank accounts you want to connect with Zoho Payments.

Note: At the moment, you can connect only one bank account to Zoho Payments.

- Once done, you will be redirected back to Zoho Payments.

Your account will be connected and you will be able to remove this account by clicking the Delete icon.

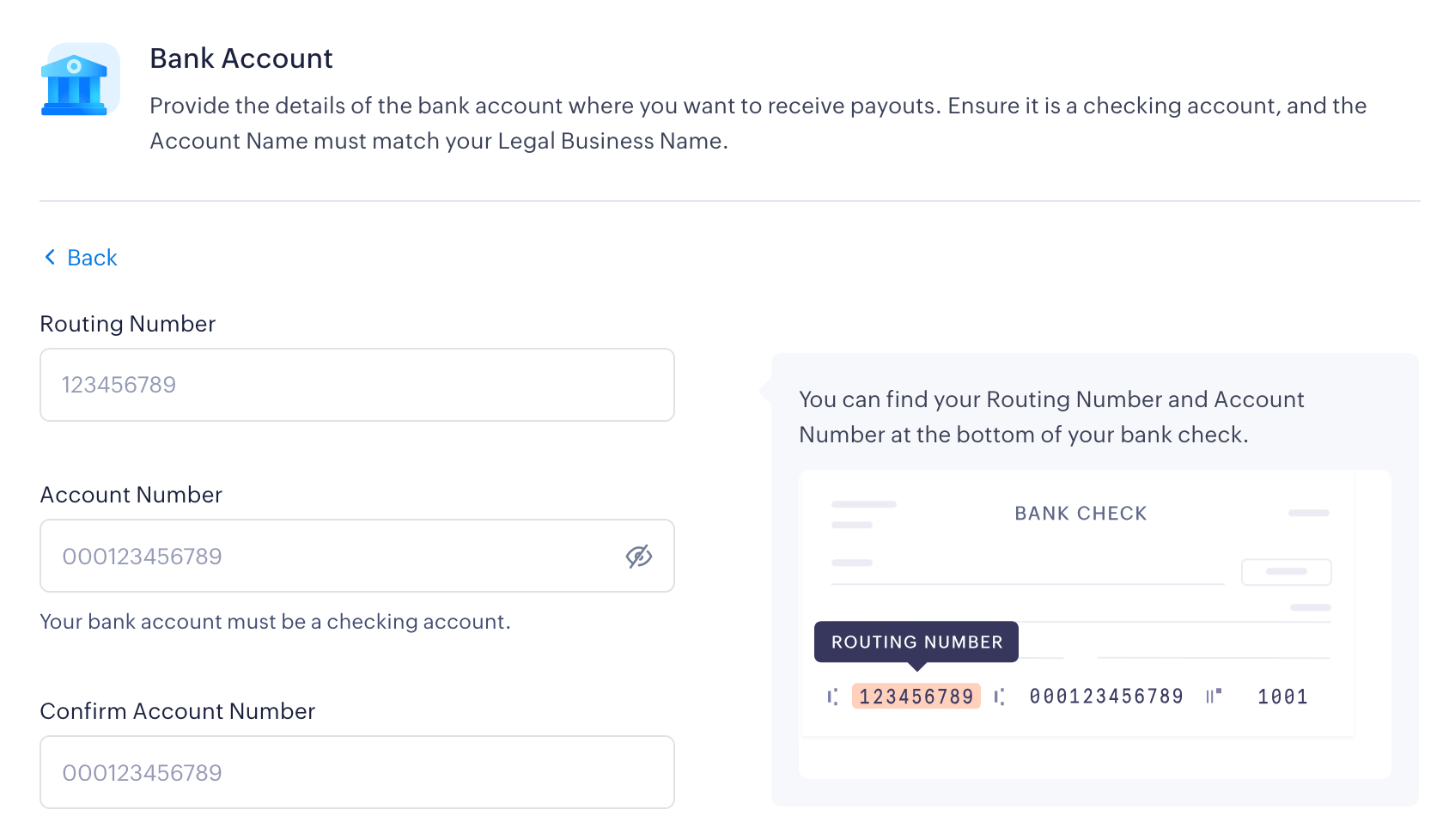

Add your bank account manually

You can also add your bank account by clicking Enter bank account details manually and providing the required details.

Routing Number

The routing number helps identify your bank, and it contains 9 digits. You can find it in the bottom-left corner of your check.

Account Number

Your account must be a checking account with an account number ranging from 5 to 17 digits; this helps in identifying your account. You can find it near your routing number at the bottom of your check.

Insight: Your profile and the transactions from the registered business bank account or personal checking account help verify whether the bank account belongs to the registered business or individuals.

Insight: During account verification, you will be requested to submit additional details, such as a canceled check or bank statement, to verify your bank account.

Learn more on why Zoho Payments requires your bank account details.