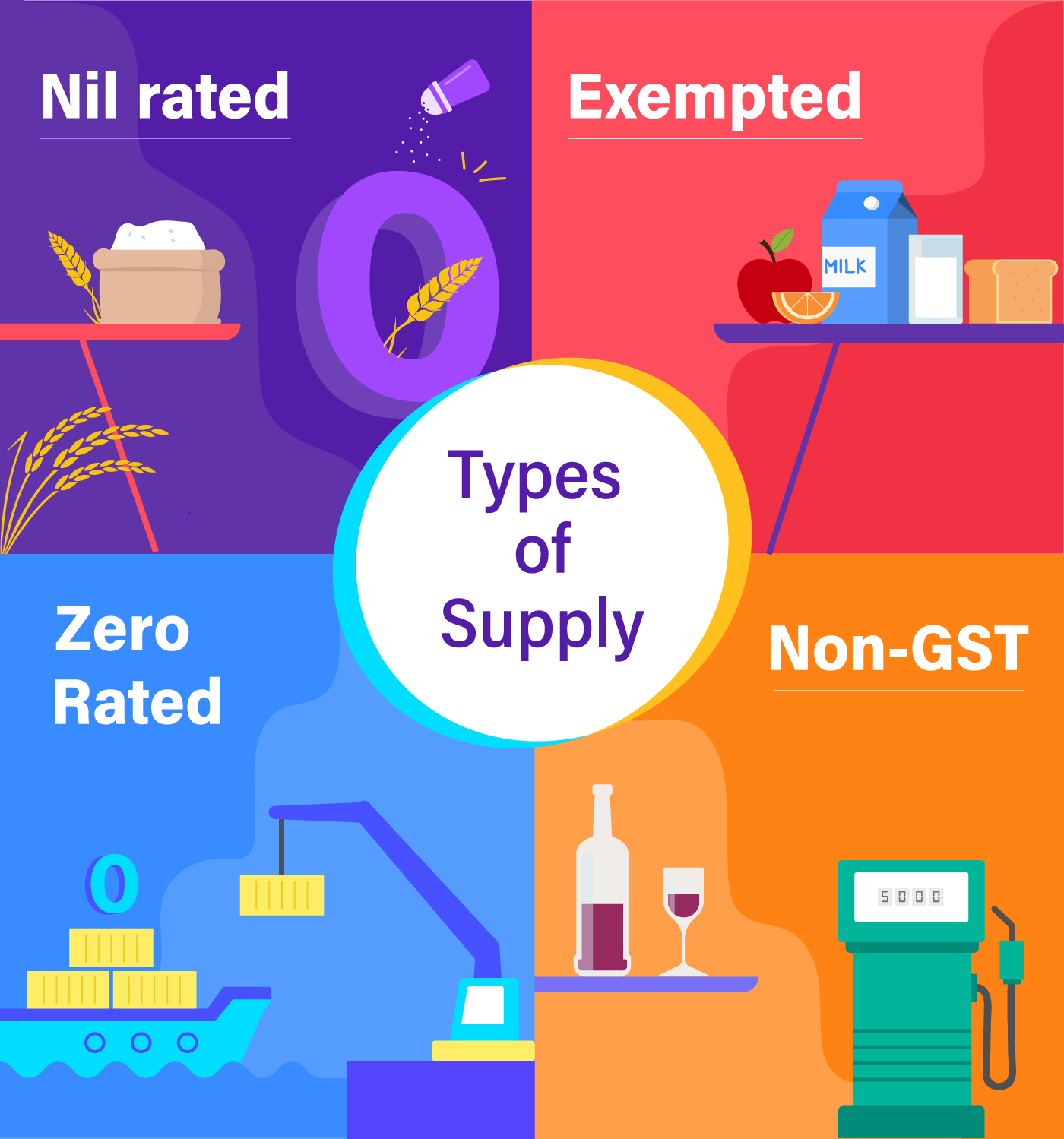

With the introduction of GST, the goods and services have been classified into Nil Rated, Exempted, Zero Rated and Non-GST supplies. Let us take a look at what distinguishes each of them.

Nil Rated

This type of supply attracts a GST of 0%. Input tax credit cannot be claimed on such supplies. Some items which are nil rated include grains, salt, jaggery, etc.

Exempted

This supply includes items which are used for everyday purposes. Since they are basic essentials, they do not attract any GST at all. You will not be able to claim any ITC on such supplies. Some examples include bread, fresh fruits, milk, curd, etc.

Zero-Rated

Supplies made overseas and to Special Economic Zones (SEZs) or SEZ Developers come under the zero-rated supplies. This supply attracts a GST of 0%. For such supplies, ITC can be claimed.

Non-GST

Supplies which don’t come under the scope of the GST are termed as Non-GST supplies. However, these supplies can attract taxes other than the GST as per the jurisdiction of the state or the country. Some examples of such supplies include petrol, alcohol, etc.

| Supply | GST Applicable | Type of Supply | Eligibility for ITC | Examples |

|---|---|---|---|---|

| Nil Rated | 0% | Everyday items | No | Grains, Salt, Jaggery, etc. |

| Exempted | - | Basic essentials | No | Bread, Fresh fruits, Fresh milk, Curd, etc. |

| Zero Rated | 0% | Overseas supplies, Supply to Special Economic Zones (SEZ) or SEZ Developers | Yes | - |

| Non-GST | - | Supplies for which GST is not applicable but can attract other taxes | No | Petrol, Alchohol, etc. |

Push GSTR-9 directly from your accounting software.